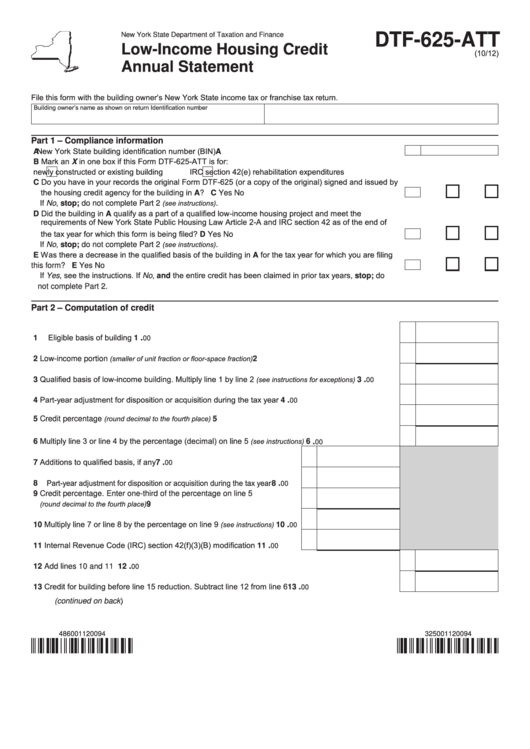

DTF-625-ATT

New York State Department of Taxation and Finance

Low-Income Housing Credit

(10/12)

Annual Statement

File this form with the building owner’s New York State income tax or franchise tax return.

Building owner’s name as shown on return

Identification number

Part 1 – Compliance information

New York State building identification number (BIN) ..................................................................................

A

A

Mark an X in one box if this Form DTF-625-ATT is for:

B

newly constructed or existing building

IRC section 42(e) rehabilitation expenditures

Do you have in your records the original Form DTF-625 (or a copy of the original) signed and issued by

C

the housing credit agency for the building in A? ....................................................................................

C

Yes

No

(see instructions)

If No, stop; do not complete Part 2

.

Did the building in A qualify as a part of a qualified low-income housing project and meet the

D

requirements of New York State Public Housing Law Article 2-A and IRC section 42 as of the end of

the tax year for which this form is being filed? .......................................................................................

D

Yes

No

(see instructions)

If No, stop; do not complete Part 2

.

Was there a decrease in the qualified basis of the building in A for the tax year for which you are filing

E

this form? ...............................................................................................................................................

E

Yes

No

If Yes, see the instructions. If No, and the entire credit has been claimed in prior tax years, stop; do

not complete Part 2.

Part 2 – Computation of credit

Eligible basis of building ..........................................................................................................................

.

1

1

00

(smaller of unit fraction or floor-space fraction)

2

Low-income portion

................................................................

2

Qualified basis of low-income building. Multiply line 1 by line 2

(see instructions for exceptions)

.

3

................

3

00

Part-year adjustment for disposition or acquisition during the tax year ...................................................

.

4

4

00

(round decimal to the fourth place)

5

Credit percentage

..................................................................................

5

Multiply line 3 or line 4 by the percentage (decimal) on line 5

(see instructions)

6

.......................................

6

.

00

Additions to qualified basis, if any ..............................................................

.

7

7

00

Part-year adjustment for disposition or acquisition during the tax year ...........

.

8

8

00

9

Credit percentage. Enter one-third of the percentage on line 5

(round decimal to the fourth place)

...............................................................

9

10 Multiply line 7 or line 8 by the percentage on line 9

(see instructions)

.

......... 10

00

11 Internal Revenue Code (IRC) section 42(f)(3)(B) modification .................. 11

.

00

.

12 Add lines 10 and 11 .................................................................................................................................. 12

00

13 Credit for building before line 15 reduction. Subtract line 12 from line 6 .................................................. 13

.

00

(continued on back)

486001120094

325001120094

1

1 2

2