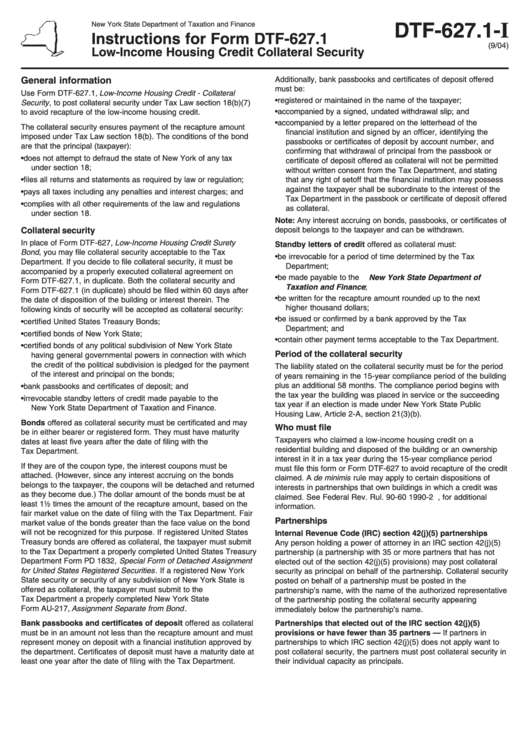

Instructions For Form Dtf-627.1 - Low-Income Housing Credit Collateral Security

ADVERTISEMENT

New York State Department of Taxation and Finance

DTF-627.1- I

Instructions for Form DTF-627.1

(9/04)

Low-Income Housing Credit Collateral Security

Additionally, bank passbooks and certificates of deposit offered

General information

must be:

Use Form DTF-627.1, Low-Income Housing Credit - Collateral

• registered or maintained in the name of the taxpayer;

Security , to post collateral security under Tax Law section 18(b)(7)

• accompanied by a signed, undated withdrawal slip; and

to avoid recapture of the low-income housing credit.

• accompanied by a letter prepared on the letterhead of the

The collateral security ensures payment of the recapture amount

financial institution and signed by an officer, identifying the

imposed under Tax Law section 18(b). The conditions of the bond

passbooks or certificates of deposit by account number, and

are that the principal (taxpayer):

confirming that withdrawal of principal from the passbook or

• does not attempt to defraud the state of New York of any tax

certificate of deposit offered as collateral will not be permitted

under section 18;

without written consent from the Tax Department, and stating

• files all returns and statements as required by law or regulation;

that any right of setoff that the financial institution may possess

against the taxpayer shall be subordinate to the interest of the

• pays all taxes including any penalties and interest charges; and

Tax Department in the passbook or certificate of deposit offered

• complies with all other requirements of the law and regulations

as collateral.

under section 18.

Note: Any interest accruing on bonds, passbooks, or certificates of

deposit belongs to the taxpayer and can be withdrawn.

Collateral security

In place of Form DTF-627, Low-Income Housing Credit Surety

Standby letters of credit offered as collateral must:

Bond , you may file collateral security acceptable to the Tax

• be irrevocable for a period of time determined by the Tax

Department. If you decide to file collateral security, it must be

Department;

accompanied by a properly executed collateral agreement on

• be made payable to the New York State Department of

Form DTF-627.1, in duplicate. Both the collateral security and

Taxation and Finance ;

Form DTF-627.1 (in duplicate) should be filed within 60 days after

• be written for the recapture amount rounded up to the next

the date of disposition of the building or interest therein. The

higher thousand dollars;

following kinds of security will be accepted as collateral security:

• be issued or confirmed by a bank approved by the Tax

• certified United States Treasury Bonds;

Department; and

• certified bonds of New York State;

• contain other payment terms acceptable to the Tax Department.

• certified bonds of any political subdivision of New York State

Period of the collateral security

having general governmental powers in connection with which

the credit of the political subdivision is pledged for the payment

The liability stated on the collateral security must be for the period

of the interest and principal on the bonds;

of years remaining in the 15-year compliance period of the building

plus an additional 58 months. The compliance period begins with

• bank passbooks and certificates of deposit; and

the tax year the building was placed in service or the succeeding

• irrevocable standby letters of credit made payable to the

tax year if an election is made under New York State Public

New York State Department of Taxation and Finance.

Housing Law, Article 2-A, section 21(3)(b).

Bonds offered as collateral security must be certificated and may

Who must file

be in either bearer or registered form. They must have maturity

Taxpayers who claimed a low-income housing credit on a

dates at least five years after the date of filing with the

residential building and disposed of the building or an ownership

Tax Department.

interest in it in a tax year during the 15-year compliance period

If they are of the coupon type, the interest coupons must be

must file this form or Form DTF-627 to avoid recapture of the credit

attached. (However, since any interest accruing on the bonds

claimed. A de minimis rule may apply to certain dispositions of

belongs to the taxpayer, the coupons will be detached and returned

interests in partnerships that own buildings in which a credit was

as they become due.) The dollar amount of the bonds must be at

claimed. See Federal Rev. Rul. 90-60 1990-2 C.B. 3, for additional

least 1½ times the amount of the recapture amount, based on the

information.

fair market value on the date of filing with the Tax Department. Fair

Partnerships

market value of the bonds greater than the face value on the bond

will not be recognized for this purpose. If registered United States

Internal Revenue Code (IRC) section 42(j)(5) partnerships

Treasury bonds are offered as collateral, the taxpayer must submit

Any person holding a power of attorney in an IRC section 42(j)(5)

to the Tax Department a properly completed United States Treasury

partnership (a partnership with 35 or more partners that has not

Department Form PD 1832, Special Form of Detached Assignment

elected out of the section 42(j)(5) provisions) may post collateral

for United States Registered Securities . If a registered New York

security as principal on behalf of the partnership. Collateral security

State security or security of any subdivision of New York State is

posted on behalf of a partnership must be posted in the

offered as collateral, the taxpayer must submit to the

partnership’s name, with the name of the authorized representative

Tax Department a properly completed New York State

of the partnership posting the collateral security appearing

Form AU-217, Assignment Separate from Bond .

immediately below the partnership’s name.

Bank passbooks and certificates of deposit offered as collateral

Partnerships that elected out of the IRC section 42(j)(5)

must be in an amount not less than the recapture amount and must

provisions or have fewer than 35 partners — If partners in

represent money on deposit with a financial institution approved by

partnerships to which IRC section 42(j)(5) does not apply want to

the department. Certificates of deposit must have a maturity date at

post collateral security, the partners must post collateral security in

least one year after the date of filing with the Tax Department.

their individual capacity as principals.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2