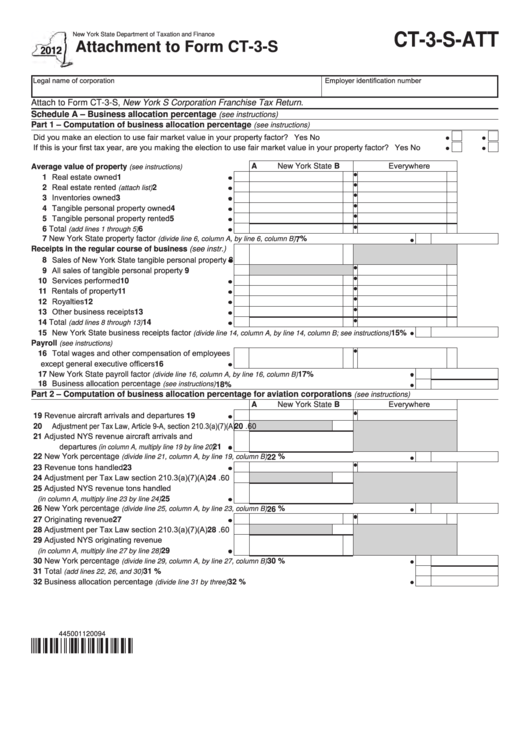

Form Ct-3-S-Att - Attachment To Form Ct-3-S - 2012

ADVERTISEMENT

New York State Department of Taxation and Finance

CT-3-S-ATT

Attachment to Form CT-3-S

Legal name of corporation

Employer identification number

Attach to Form CT-3-S, New York S Corporation Franchise Tax Return.

Schedule A – Business allocation percentage

(see instructions)

Part 1 – Computation of business allocation percentage

(see instructions)

Did you make an election to use fair market value in your property factor? ............................................................... Yes

No

If this is your first tax year, are you making the election to use fair market value in your property factor? ................. Yes

No

B Everywhere

A New York State

Average value of property

(see instructions)

1 Real estate owned ..................................................

1

2 Real estate rented

..................................

2

(attach list)

3 Inventories owned ...................................................

3

4 Tangible personal property owned ..........................

4

5 Tangible personal property rented ..........................

5

6 Total

.......................................

6

(add lines 1 through 5)

7 New York State property factor

...................................................

%

(divide line 6, column A, by line 6, column B)

7

Receipts in the regular course of business (see instr.)

8 Sales of New York State tangible personal property

8

9 All sales of tangible personal property ......................

9

10 Services performed .................................................

10

11 Rentals of property..................................................

11

12 Royalties .................................................................

12

13 Other business receipts ..........................................

13

14 Total

......................................

14

(add lines 8 through 13)

15 New York State business receipts factor

.........

15

%

(divide line 14, column A, by line 14, column B; see instructions)

Payroll

(see instructions)

16 Total wages and other compensation of employees

except general executive officers ........................

16

17 New York State payroll factor

..................................................

17

%

(divide line 16, column A, by line 16, column B)

18 Business allocation percentage

.........................................................................................

(see instructions)

18

%

Part 2 – Computation of business allocation percentage for aviation corporations

(see instructions)

B Everywhere

A New York State

19 Revenue aircraft arrivals and departures ................

19

20 Adjustment per Tax Law, Article 9-A, section 210.3(a)(7)(A) 20

.60

21 Adjusted NYS revenue aircraft arrivals and

departures

......

21

(in column A, multiply line 19 by line 20)

22 New York percentage

..............................................................

%

(divide line 21, column A, by line 19, column B)

22

23 Revenue tons handled ............................................

23

24 Adjustment per Tax Law section 210.3(a)(7)(A) ........ 24

.60

25 Adjusted NYS revenue tons handled

....................

25

(in column A, multiply line 23 by line 24)

26 New York percentage

..............................................................

%

(divide line 25, column A, by line 23, column B)

26

27 Originating revenue.................................................

27

28 Adjustment per Tax Law section 210.3(a)(7)(A) ........ 28

.60

29 Adjusted NYS originating revenue

....................

29

(in column A, multiply line 27 by line 28)

30 New York percentage

..............................................................

30

%

(divide line 29, column A, by line 27, column B)

31 Total

......................................................................................................................... 31

%

(add lines 22, 26, and 30)

32 Business allocation percentage

................................................................................

32

%

(divide line 31 by three)

445001120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2