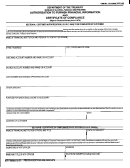

Instructions For Form 500

General Information

Form 500 may be used by a taxpayer to Either:

A disclosure authorized by this form may take place by

telephone, letter, facsimile, or e-mail (if that information is

1.

Authorize the Offi ce of State Tax Commissioner to disclose

provided and Box C is also checked).

confi dential tax information with respect to the taxpayer

to another individual or fi rm not otherwise entitled to the

To change a Form 500 previously fi led, a taxpayer must complete

information; or

and fi le a new Form 500. The fi ling of a new Form 500 will

automatically revoke all authorizations and designations

2. Designate another individual or fi rm to represent or act on

previously made.

behalf of the taxpayer and authorize the Offi ce of State Tax

Commissioner to disclose confi dential tax information to the

Mail the completed Form 500 to: Offi ce of State Tax

designated representative.

Commissioner, 600 E. Boulevard Ave., Dept. 127, Bismarck, ND

58505-0599.

Completing Form 500

Taxpayer Information

Box C - Check this box to authorize the Offi ce of State Tax

For an individual - Enter the individual’s name, telephone

number, social security number, and mailing address.

Commissioner to use facsimile or e-mail to disclose

confi dential tax information to the designated individual

For a corporation, partnership, LLP, or LLC - Enter the name,

or fi rm.

telephone number, federal identifi cation number, and business

address.

Box D - Check this box if Form 500 is being fi led to revoke all

previously made authorization(s).

For a trust - Enter the name, telephone number, and federal

Note:

If a separate sheet is being attached to identify additional

identifi cation number of the trust, and the name and address of

the fi duciary.

designated individuals or fi rms, indicate the authority

being given by entering “Box A” or “Box B,” and

For an estate - Enter the name and social security number or

“Box C”, if desired, next to each one listed.

federal identifi cation number of the decedent, and the name,

telephone number, and address of the decedent’s personal

Type of Tax, Form Number, Tax Year or Period

representative or fi duciary for the estate.

If limiting authorization or designation to a certain tax type, form,

or taxable year or period, enter the type of tax (e.g., Individual

Income Tax or Corporation Income Tax), the form number (e.g.,

Designated Individual or Firm

Enter the name, title, telephone number, social security number

Form ND-1 of Form 40), and tax year(s) or period(s) (e.g., 2002

or federal identifi cation number, and mailing address of the

or Tax period ending June 30, 2002). If more space is needed,

designated individual or fi rm. To authorize the disclosure of

attach an additional sheet.

confi dential tax information by facsimile or e-mail, enter the

facsimile number or e-mail address, or both, and check Box C

Signature of Taxpayer(s)

on the form. If designating more than one individual or fi rm,

For a partnership - One of the general partners must sign.

identify on a separate sheet and attach it to Form 500.

For a corporation - An offi cer having authority to bind the

Which Box To Check

corporation must sign.

Box A - Check this box if Form 500 is being fi led to Only

authorize the Offi ce of State Tax Commissioner to

For an LLC or LLP - A governor, manager, responsible member

or partner must sign.

disclose confi dential tax information to an individual or

fi rm other than the taxpayer.

For an estate, trust, or any other situation where there is a

Box B - Check this box if Form 500 is being fi led to designate

fi duciary relationship - The personal representative, trustee,

guardian, conservator, or other fi duciary must sign.

another individual or fi rm to represent or act on

behalf of the taxpayer. Checking this box also

authorizes the Offi ce of State Tax Commissioner to

disclose confi dential tax information to the designated

representative.

1

1 2

2