Form Dtf-911 - Request For Assistance From The Office Of The Taxpayer Rights Advocate

ADVERTISEMENT

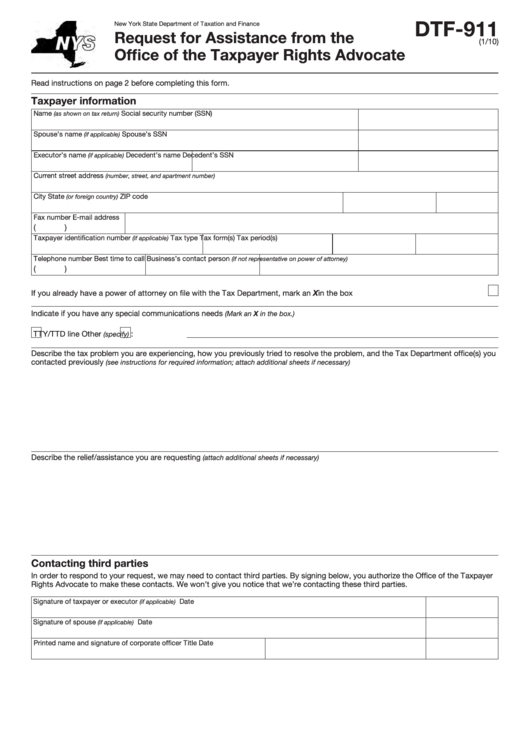

DTF-911

New York State Department of Taxation and Finance

Request for Assistance from the

(1/10)

Office of the Taxpayer Rights Advocate

Read instructions on page 2 before completing this form.

Taxpayer information

Name

Social security number (SSN)

(as shown on tax return)

Spouse’s name

Spouse’s SSN

(if applicable)

Executor’s name

Decedent’s name

Decedent’s SSN

(if applicable)

Current street address

(number, street, and apartment number)

City

State

ZIP code

(or foreign country)

Fax number

E-mail address

(

)

Taxpayer identification number

Tax type

Tax form(s)

Tax period(s)

(if applicable)

Telephone number

Best time to call

Business’s contact person

(if not representative on power of attorney)

(

)

If you already have a power of attorney on file with the Tax Department, mark an X in the box ............................................................

Indicate if you have any special communications needs

(Mark an X in the box.)

TTY/TTD line

Other

:

(specify)

Describe the tax problem you are experiencing, how you previously tried to resolve the problem, and the Tax Department office(s) you

contacted previously

(see instructions for required information; attach additional sheets if necessary)

Describe the relief/assistance you are requesting

(attach additional sheets if necessary)

Contacting third parties

In order to respond to your request, we may need to contact third parties. By signing below, you authorize the Office of the Taxpayer

Rights Advocate to make these contacts. We won’t give you notice that we’re contacting these third parties.

Signature of taxpayer or executor

Date

(if applicable)

Signature of spouse

Date

(if applicable)

Printed name and signature of corporate officer

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2