Form Dtf-5 - Statement Of Financial Condition And Other Information - New York State Department Of Taxation And Finance Page 6

ADVERTISEMENT

Page 6 DTF-5 (12/08)

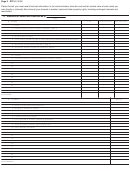

XV. Statement of Income - Corporation

Important: If the proposal is from a corporation, please furnish the information requested below

(from income tax returns, as adjusted, for

past two years and from records for current year from January 1 to date).

Type of corporation:

business

not‑for‑profit

P.C.

Attach a detailed statement of carry over/carry back loss intentions. If you do not intend to use this offset, attach a full explanation.

20

20

Jan. 1 to

20

A. Gross income

1. Gross sales or receipts

(subtract returns and allowances)

2. Cost of goods sold

3. Gross profit — trading or manufacturing

4. Gross profit — from other sources

5. Interest income

6. Rents and royalties

7. Gains and losses

(from Schedule D)

8. Dividends

9. Other

(specify)

Total income

B. Deductions

1. Compensation of officers

2. Salaries and wages

(not deducted elsewhere)

3. Rents

4. Repairs

5. Bad debts

6. Interest

7. Taxes

8. Losses

9. Dividends

10. Depreciation and depletion

11. Contributions

12. Advertising

13. Other

(specify)

14.

Total deductions

C. Net income

D. Nontaxable income

E. Unallowable deductions

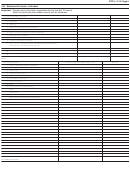

XVI. Salaries Paid to Principal Officers and Dividends Distributed - Corporation

Important: If the proposal is from a corporation, please show salaries paid to principal officers for past three years and amounts distributed

in dividends, if any, during and since the taxable years covered by this offer.

20

20

20

A. Salaries paid to (name and title)

1.

, President

2.

, Vice President

3.

, Treasurer

4.

, Secretary

5.

6.

Total

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8