Form S&u C3 - Instructions For Filing Tax Returns

ADVERTISEMENT

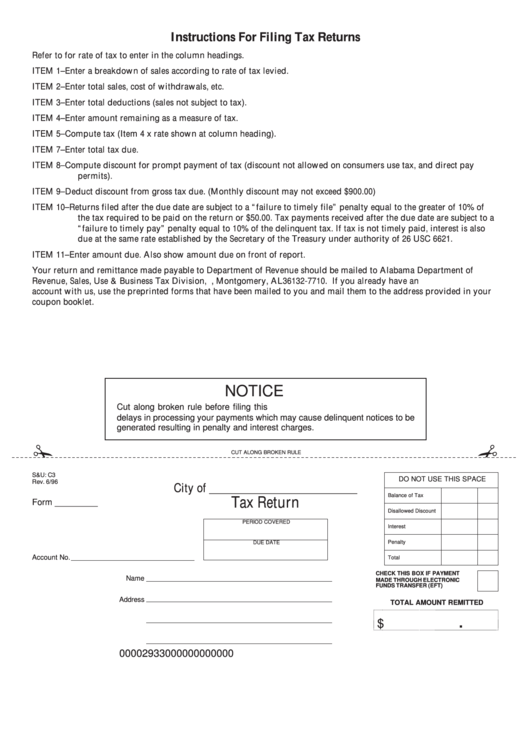

Instructions For Filing Tax Returns

Refer to for rate of tax to enter in the column headings.

ITEM 1 – Enter a breakdown of sales according to rate of tax levied.

ITEM 2 – Enter total sales, cost of withdrawals, etc.

ITEM 3 – Enter total deductions (sales not subject to tax).

ITEM 4 – Enter amount remaining as a measure of tax.

ITEM 5 – Compute tax (Item 4 x rate shown at column heading).

ITEM 7 – Enter total tax due.

ITEM 8 – Compute discount for prompt payment of tax (discount not allowed on consumers use tax, and direct pay

permits).

ITEM 9 – Deduct discount from gross tax due. (Monthly discount may not exceed $900.00)

ITEM 10 – Returns filed after the due date are subject to a “failure to timely file” penalty equal to the greater of 10% of

the tax required to be paid on the return or $50.00. Tax payments received after the due date are subject to a

“failure to timely pay” penalty equal to 10% of the delinquent tax. If tax is not timely paid, interest is also

due at the same rate established by the Secretary of the Treasury under authority of 26 USC 6621.

ITEM 11 – Enter amount due. Also show amount due on front of report.

Your return and remittance made payable to Department of Revenue should be mailed to Alabama Department of

Revenue, Sales, Use & Business Tax Division, P.O. Box 327710, Montgomery, AL 36132-7710. If you already have an

account with us, use the preprinted forms that have been mailed to you and mail them to the address provided in your

coupon booklet.

NOTICE

Cut along broken rule before filing this return. Failure to do so will result in

delays in processing your payments which may cause delinquent notices to be

generated resulting in penalty and interest charges.

CUT ALONG BROKEN RULE

S&U: C3

DO NOT USE THIS SPACE

Rev. 6/96

City of

________________________________

Balance of Tax

Tax Return

Form _________

Disallowed Discount

PERIOD COVERED

Interest

Penalty

DUE DATE

Account No.

Total

CHECK THIS BOX IF PAYMENT

Name

MADE THROUGH ELECTRONIC

FUNDS TRANSFER (EFT)

Address

TOTAL AMOUNT REMITTED

@ @ e

@ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e

@ @

@ @ e

@ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e

@ @

@ @ @ @

@ @ @ @

@ @

@ @ @ @

@ @

@ @ @ @

@ @ @ @

@ @

@ @

.

@ @

@ @

@ @

@ @

@ @

@ @

@ @

@ @

@ @ @ @

@ @ @ @

@ @ @ @

@ @ @ @

@ @ @ @

@ @ @ @

@ @

@ @

@ @

@ @

@ @ @ @

@ @ @ @

$

@ @

@ @

@ @ @ @

@ @ @ @

@ @

@ @

@ @

@ @

@ @

@ @

@ @

@ @

@ @ @ @

@ @ @ @

@ @

@ @

@ @ @ @

@ @ @ @

@ @ @ @

@ @ @ @

@ @ @ @

@ @ @ @

@ @

@ @

@ @ @ @

@ @

@ @

@ @

@ @

@ @

@ @

@ @ @ @

@ @

@ @

@ @ @ @

@ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @

@ @ @ @

@ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @ e @ @

00002933000000000000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2