Sales and Use Tax General Information

Sellers must hold the sales and use taxes they collect in trust for

• Tax Type Amounts: If required to file sales-related taxes

the benefit of the state and for payment to the Tax Commission.

(restaurant, transient room, etc.), include the amount you are

See Utah Code Title 59, Chapter 12.

paying for each tax type on the sales tax payment coupon.

• Returns and Schedules: You must use the TC-62 series of

• Information Updates: Contact the Tax Commission immedi-

forms and schedules. Filing requirements are based on the

ately if account information changes. Submit changes on the

nature of your business. You may be penalized if you do not file

following forms:

the correct forms and schedules. See Pub 25, Sales and Use

• TC-69, Utah State Business and Tax Registration — open

Tax General Information, to determine which forms and sched-

a new business, change ownership

ules you must file.

• TC-69B, Additional Business Locations for a Sales Tax

• Paper Forms: If you do not want to receive paper returns in the

Account — add additional outlets to your account

mail, mark “Stop Receiving Paper Forms” on the sales and use

• TC-69C, Notice of Change for a Sales Tax Account —

tax return. Mark this if you file online or if you use substitute

change address, close an outlet or account, add or remove

forms (see below). You still must file sales and use tax returns

an officer or owner

even if you choose to stop receiving paper forms.

• Taxpayer Resources: The Tax Commission offers free sales

• Amended Return: To amend a previously filed return, mark

and use tax training and online workshops to help taxpayers

“Amended Return” on the sales and use tax return and enter

understand Utah taxes. Visit tax.utah.gov/training for a list of

the period being amended on the Period line. File amended

all training resources.

returns with corrected amounts, not net amounts. Calculate the

refund or balance due by subtracting the original payment from

For more information or access to online services, forms or publica-

the corrected tax due. Pay the balance due or attach a letter

tions, go online to tax.utah.gov. You can email questions to

asking for a refund of the overpayment. Failure to pay all

taxmaster@utah.gov. You may also write or visit the Utah State Tax

additional tax and interest with the amended return will result in

Commission at 210 North 1950 West, Salt Lake City, UT

a late payment penalty.

84134-0400, or telephone 801-297-2200 or 1-800-662-4335 (outside

the Salt Lake area).

• File Returns Online: Sellers may file sales and use tax returns

and schedules online. Go to taxexpress.utah.gov. To register,

___________________ _

use the PIN printed on your return.

• Substitute Forms: Substitute sales tax return forms must meet

If you need an accommodation under the Americans with Disabili-

all specifications and be approved by the Tax Commission prior

ties Act, contact the Tax Commission at 801-297-3811 or TDD

to use. See Pub 99, Guidelines for Substitute and Copied Utah

801-297-2020. Please allow three working days for a response.

Tax Forms, at tax.utah.gov/forms. Failure to use approved

substitute forms may result in a penalty.

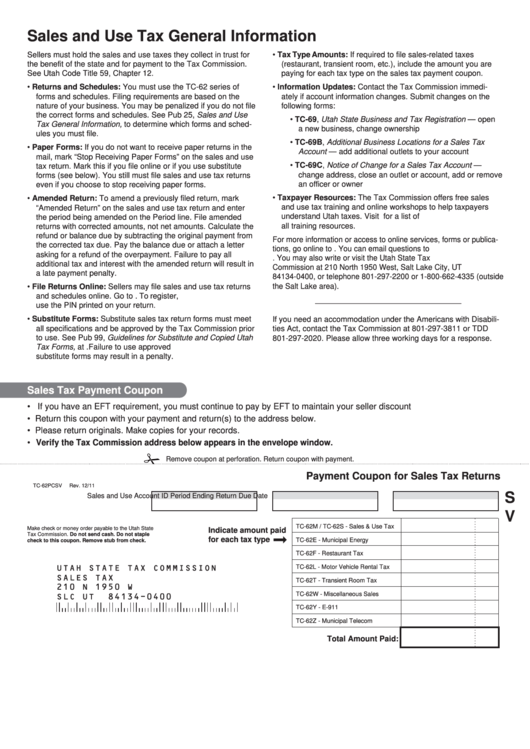

Sales Tax Payment Coupon

• If you have an EFT requirement, you must continue to pay by EFT to maintain your seller discount

• Return this coupon with your payment and return(s) to the address below.

• Please return originals. Make copies for your records.

• Verify the Tax Commission address below appears in the envelope window.

Remove coupon at perforation. Return coupon with payment.

Payment Coupon for Sales Tax Returns

TC-62PCSV

Rev. 12/11

S

Sales and Use Account ID

Period Ending

Return Due Date

V

TC-62M / TC-62S - Sales & Use Tax

Make check or money order payable to the Utah State

Indicate amount paid

Tax Commission. Do not send cash. Do not staple

for each tax type

TC-62E - Municipal Energy

check to this coupon. Remove stub from check.

TC-62F - Restaurant Tax

UTAH STATE TAX COMMISSION

TC-62L - Motor Vehicle Rental Tax

SALES TAX

TC-62T - Transient Room Tax

210 N 1950 W

TC-62W - Miscellaneous Sales

SLC UT

84134-0400

TC-62Y - E-911

TC-62Z - Municipal Telecom

Total Amount Paid:

1

1