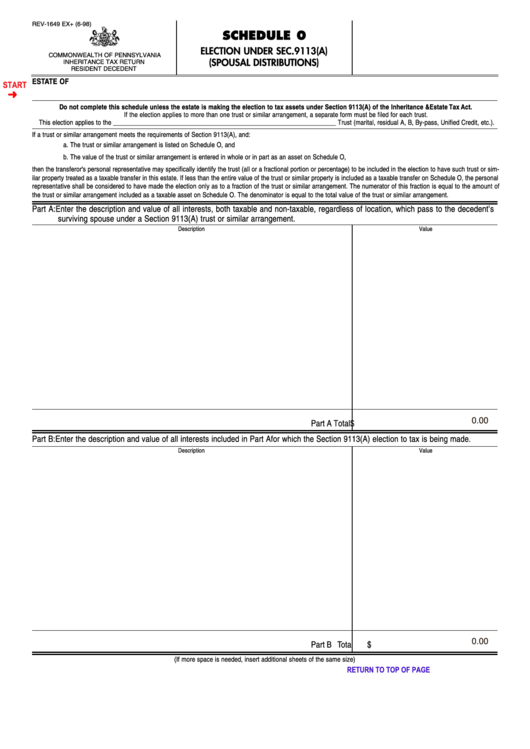

REV-1649 EX+ (6-98)

SCHEDULE 0

ELECTION UNDER SEC.9113(A)

COMMONWEALTH OF PENNSYLVANIA

(SPOUSAL DISTRIBUTIONS)

INHERITANCE TAX RETURN

RESIDENT DECEDENT

ESTATE OF

FILE NUMBER

START

Do not complete this schedule unless the estate is making the election to tax assets under Section 9113(A) of the Inheritance & Estate Tax Act.

If the election applies to more than one trust or similar arrangement, a separate form must be filed for each trust.

This election applies to the __________________________________________________________________ Trust (marital, residual A, B, By-pass, Unified Credit, etc.).

If a trust or similar arrangement meets the requirements of Section 9113(A), and:

a. The trust or similar arrangement is listed on Schedule O, and

b. The value of the trust or similar arrangement is entered in whole or in part as an asset on Schedule O,

then the transferor's personal representative may specifically identify the trust (all or a fractional portion or percentage) to be included in the election to have such trust or sim-

ilar property treated as a taxable transfer in this estate. If less than the entire value of the trust or similar property is included as a taxable transfer on Schedule O, the personal

representative shall be considered to have made the election only as to a fraction of the trust or similar arrangement. The numerator of this fraction is equal to the amount of

the trust or similar arrangement included as a taxable asset on Schedule O. The denominator is equal to the total value of the trust or similar arrangement.

Part A: Enter the description and value of all interests, both taxable and non-taxable, regardless of location, which pass to the decedent’s

surviving spouse under a Section 9113(A) trust or similar arrangement.

Description

Value

0.00

Part A Total $

Part B: Enter the description and value of all interests included in Part A for which the Section 9113(A) election to tax is being made.

Description

Value

0.00

Part B Total $

(If more space is needed, insert additional sheets of the same size)

RETURN TO TOP OF PAGE

PRINT FORM

Reset Entire Form

1

1