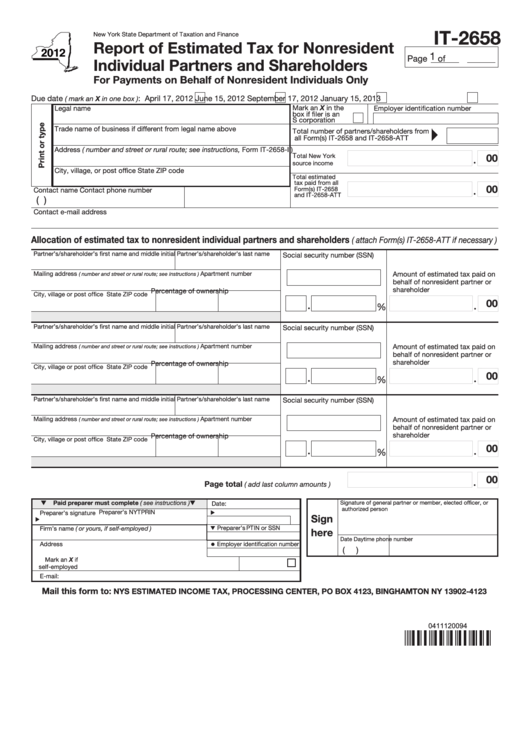

IT-2658

New York State Department of Taxation and Finance

Report of Estimated Tax for Nonresident

1

Page

of

Individual Partners and Shareholders

For Payments on Behalf of Nonresident Individuals Only

Due date

: April 17, 2012

June 15, 2012

September 17, 2012

January 15, 2013

( mark an X in one box )

Mark an X in the

Legal name

Employer identification number

box if filer is an

S corporation .......

Trade name of business if different from legal name above

Total number of partners/shareholders from

all Form(s) IT‑2658 and IT‑2658‑ATT

Address ( number and street or rural route; see instructions, Form IT‑2658‑I )

T

00

otal New York

source income ....

City, village, or post office

State

ZIP code

Total estimated

tax paid from all

00

Form(s) IT‑2658

Contact name

Contact phone number

and IT‑2658‑ATT

(

)

Contact e‑mail address

Allocation of estimated tax to nonresident individual partners and shareholders

( attach Form(s) IT-2658-ATT if necessary )

Partner’s/shareholder’s first name and middle initial

Partner’s/shareholder’s last name

Social security number (SSN)

Mailing address

Apartment number

Amount of estimated tax paid on

( number and street or rural route; see instructions )

behalf of nonresident partner or

shareholder

Percentage of ownership

City, village or post office

State

ZIP code

00

%

Partner’s/shareholder’s first name and middle initial

Partner’s/shareholder’s last name

Social security number (SSN)

Mailing address

Apartment number

Amount of estimated tax paid on

( number and street or rural route; see instructions )

behalf of nonresident partner or

shareholder

Percentage of ownership

City, village or post office

State

ZIP code

00

%

Partner’s/shareholder’s first name and middle initial

Partner’s/shareholder’s last name

Social security number (SSN)

Mailing address

Apartment number

Amount of estimated tax paid on

( number and street or rural route; see instructions )

behalf of nonresident partner or

shareholder

Percentage of ownership

City, village or post office

State

ZIP code

00

%

00

Page total

.....

( add last column amounts )

Paid preparer must complete ( see instructions )

Signature of general partner or member, elected officer, or

Date:

authorized person

Preparer’s NYTPRIN

Preparer’s signature

Sign

Preparer’s PTIN or SSN

Firm’s name ( or yours, if self-employed )

here

Date

Daytime phone number

Address

Employer identification number

(

)

Mark an X if

self‑employed

E‑mail:

Mail this form to:

NYS ESTIMATED INCOME TAX, PROCESSING CENTER, PO BOX 4123, BINGHAMTON NY 13902-4123

0411120094

1

1 2

2