Form Rpd-41340 - Blended Biodiesel Fuel Tax Credit Claim Form - State Of New Mexico Taxation And Revenue Department

ADVERTISEMENT

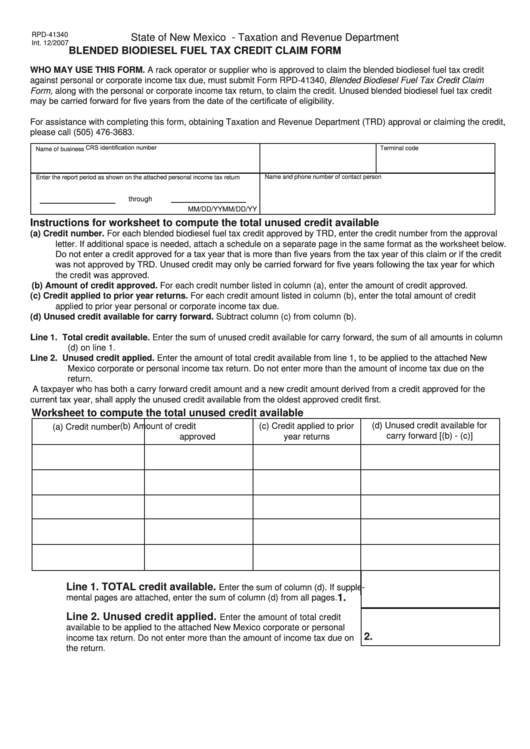

RPD-41340

State of New Mexico - Taxation and Revenue Department

Int. 12/2007

BLENDED BIODIESEL FUEL TAX CREDIT CLAIM FORM

WHO MAY USE THIS FORM. A rack operator or supplier who is approved to claim the blended biodiesel fuel tax credit

against personal or corporate income tax due, must submit Form RPD-41340, Blended Biodiesel Fuel Tax Credit Claim

Form, along with the personal or corporate income tax return, to claim the credit. Unused blended biodiesel fuel tax credit

may be carried forward for five years from the date of the certificate of eligibility.

For assistance with completing this form, obtaining Taxation and Revenue Department (TRD) approval or claiming the credit,

please call (505) 476-3683.

CRS identification number

Terminal code

Name of business

Name and phone number of contact person

Enter the report period as shown on the attached personal income tax return

through

MM/DD/YY

MM/DD/YY

Instructions for worksheet to compute the total unused credit available

(a)

Credit number. For each blended biodiesel fuel tax credit approved by TRD, enter the credit number from the approval

letter. If additional space is needed, attach a schedule on a separate page in the same format as the worksheet below.

Do not enter a credit approved for a tax year that is more than five years from the tax year of this claim or if the credit

was not approved by TRD. Unused credit may only be carried forward for five years following the tax year for which

the credit was approved.

(b)

Amount of credit approved. For each credit number listed in column (a), enter the amount of credit approved.

(c)

Credit applied to prior year returns. For each credit amount listed in column (b), enter the total amount of credit

applied to prior year personal or corporate income tax due.

(d)

Unused credit available for carry forward. Subtract column (c) from column (b).

Line 1. Total credit available. Enter the sum of unused credit available for carry forward, the sum of all amounts in column

(d) on line 1.

Line 2. Unused credit applied. Enter the amount of total credit available from line 1, to be applied to the attached New

Mexico corporate or personal income tax return. Do not enter more than the amount of income tax due on the

return.

A taxpayer who has both a carry forward credit amount and a new credit amount derived from a credit approved for the

current tax year, shall apply the unused credit available from the oldest approved credit first.

Worksheet to compute the total unused credit available

(d) Unused credit available for

(c) Credit applied to prior

(b) Amount of credit

(a) Credit number

carry forward [(b) - (c)]

approved

year returns

Line 1. TOTAL credit available.

Enter the sum of column (d). If supple-

1.

mental pages are attached, enter the sum of column (d) from all pages.

Line 2. Unused credit applied.

Enter the amount of total credit

available to be applied to the attached New Mexico corporate or personal

2.

income tax return. Do not enter more than the amount of income tax due on

the return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2