B&L: MFT-PRO

A

D

R

LABAMA

EPARTMENT OF

EVENUE

1/12

RESET

B

& L

T

D

USINESS

ICENSE

AX

IVISION

M

F

S

OTOR

UELS

ECTION

P.O. Box 327540 • Montgomery, AL 36132-7540 • (334) 242-9608 • Fax (334) 242-1199

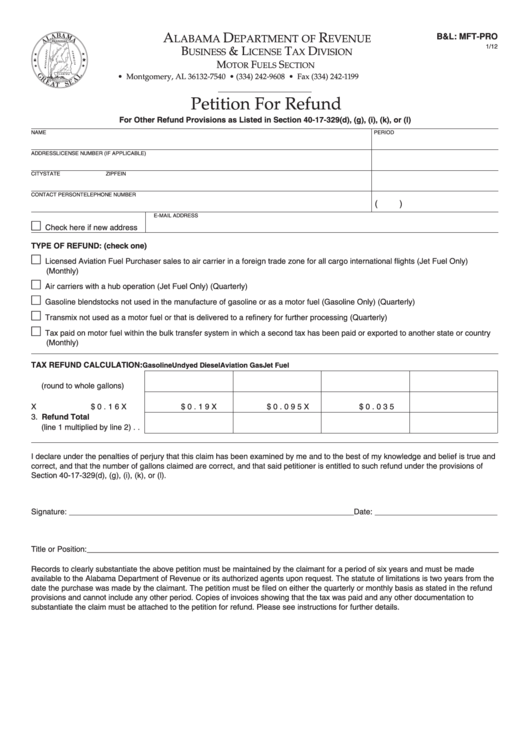

Petition For Refund

For Other Refund Provisions as Listed in Section 40-17-329(d), (g), (i), (k), or (l)

NAME

PERIOD

ADDRESS

LICENSE NUMBER (IF APPLICABLE)

CITY

STATE

ZIP

FEIN

CONTACT PERSON

TELEPHONE NUMBER

(

)

E-MAIL ADDRESS

Check here if new address

TYPE OF REFUND: (check one)

Licensed Aviation Fuel Purchaser sales to air carrier in a foreign trade zone for all cargo international flights (Jet Fuel Only)

(Monthly)

Air carriers with a hub operation (Jet Fuel Only) (Quarterly)

Gasoline blendstocks not used in the manufacture of gasoline or as a motor fuel (Gasoline Only) (Quarterly)

Transmix not used as a motor fuel or that is delivered to a refinery for further processing (Quarterly)

Tax paid on motor fuel within the bulk transfer system in which a second tax has been paid or exported to another state or country

(Monthly)

TAX REFUND CALCULATION:

Gasoline

Undyed Diesel

Aviation Gas

Jet Fuel

1. Total gallons

(round to whole gallons). . . .

2. Excise tax rate . . . . . . . . . . .

X

$0.16

X

$0.19

X

$0.095

X

$0.035

3. Refund Total

(line 1 multiplied by line 2) . .

I declare under the penalties of perjury that this claim has been examined by me and to the best of my knowledge and belief is true and

correct, and that the number of gallons claimed are correct, and that said petitioner is entitled to such refund under the provisions of

Section 40-17-329(d), (g), (i), (k), or (l).

Signature: _________________________________________________________________ Date: ____________________________

Title or Position: ______________________________________________________________________________________________

Records to clearly substantiate the above petition must be maintained by the claimant for a period of six years and must be made

available to the Alabama Department of Revenue or its authorized agents upon request. The statute of limitations is two years from the

date the purchase was made by the claimant. The petition must be filed on either the quarterly or monthly basis as stated in the refund

provisions and cannot include any other period. Copies of invoices showing that the tax was paid and any other documentation to

substantiate the claim must be attached to the petition for refund. Please see instructions for further details.

1

1 2

2