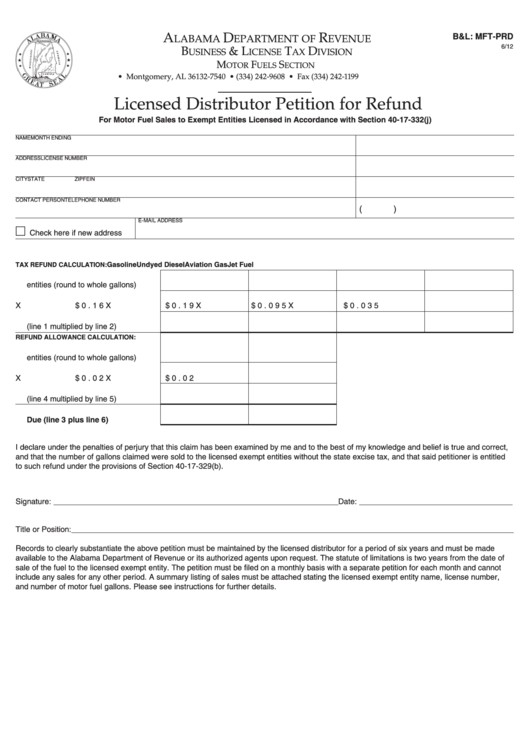

B&L: MFT-PRD

A

D

R

LABAMA

EPARTMENT OF

EVENUE

RESET

6/12

B

& L

T

D

USINESS

ICENSE

AX

IVISION

M

F

S

OTOR

UELS

ECTION

P.O. Box 327540 • Montgomery, AL 36132-7540 • (334) 242-9608 • Fax (334) 242-1199

Licensed Distributor Petition for Refund

For Motor Fuel Sales to Exempt Entities Licensed in Accordance with Section 40-17-332(j)

NAME

MONTH ENDING

ADDRESS

LICENSE NUMBER

CITY

STATE

ZIP

FEIN

CONTACT PERSON

TELEPHONE NUMBER

(

)

E-MAIL ADDRESS

Check here if new address

TAX REFUND CALCULATION:

Gasoline

Undyed Diesel

Aviation Gas

Jet Fuel

1. Total gallons sold to licensed exempt

entities (round to whole gallons) . . . .

2. Excise tax rate . . . . . . . . . . . . . . . . . .

X

$0.16

X

$0.19

X

$0.095

X

$0.035

3. Refund total

(line 1 multiplied by line 2) . . . . . . . . .

REFUND ALLOWANCE CALCULATION:

4. Total gallons sold to licensed exempt

entities (round to whole gallons) . . . .

5. Refund allowance rate . . . . . . . . . . . .

X

$0.02

X

$0.02

6. Allowance total

(line 4 multiplied by line 5) . . . . . . . . .

7. Total Refund and Allowance

Due (line 3 plus line 6) . . . . . . . . . .

I declare under the penalties of perjury that this claim has been examined by me and to the best of my knowledge and belief is true and correct,

and that the number of gallons claimed were sold to the licensed exempt entities without the state excise tax, and that said petitioner is entitled

to such refund under the provisions of Section 40-17-329(b).

Signature: _________________________________________________________________ Date: ___________________________________

Title or Position: _____________________________________________________________________________________________________

Records to clearly substantiate the above petition must be maintained by the licensed distributor for a period of six years and must be made

available to the Alabama Department of Revenue or its authorized agents upon request. The statute of limitations is two years from the date of

sale of the fuel to the licensed exempt entity. The petition must be filed on a monthly basis with a separate petition for each month and cannot

include any sales for any other period. A summary listing of sales must be attached stating the licensed exempt entity name, license number,

and number of motor fuel gallons. Please see instructions for further details.

1

1 2

2 3

3