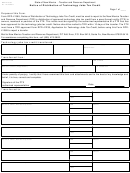

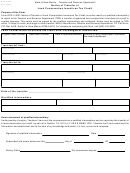

Form Rpd-41356 - Pass-Through Entity Owner'S Quarterly Tax Payment - State Of New Mexico Taxation And Revenue Department Page 2

ADVERTISEMENT

STATE OF NEW MEXICO

RPD-41356

Rev 07/18/2012

TAXATION AND REVENUE DEPARTMENT

Pass-Through Entity Owner's

Quarterly Tax Payment Instructions

Page 1 of 2

An owner of a PTE who has entered into an agreement with

payment such as estimated payments. The owner can

the PTE that the owner pay the amount that the PTE would

also satisfy the terms of the agreement by filing its New

have been required to withhold and remit to the Department

Mexico income tax return and paying the tax due. The

on behalf of the owner pursuant to the Oil and Gas Proceeds

PTE must have a completed Form RPD-41353, Owner's

and Pass-Through Entity Withholding Tax Act, submits the

or Remittee's Agreement to Pay Withholding On Behalf

withholding tax due on Form RPD-41356, Pass-Through Entity

of a Pass-Through Entity or Remitter, on file at the time

Owner's Quarterly Tax Payment, on the due date of this return.

it files its return for the tax year to which the agreement

The PTE must have a completed Form RPD-41353, Owner's

pertains. If the Department notifies the PTE that the owner

has failed to remit the required payment, the agreement

or Remittee's Agreement to Pay Withholding on Behalf of a

Pass-Through Entity or Remitter, on file at the time it files its

is no longer acceptable by the Department as reasonable

annual return for the tax year to which the agreement pertains.

cause for failure to withhold. The PTE is not responsible

for withholding on the net income earned in quarters that

The owner can satisfy its requirement to file and pay the

ended prior to the Department’s notification.

liability due on this return by:

•

The owner maintains its place of business or residence

•

filing and paying the required tax due on this Form, RPD-

in New Mexico:

41356, or

•

If a corporation, a signed Form RPD-41354, Decla-

•

timely filing its annual New Mexico personal income tax

ration of Principal Place of Business or Residence in

or corporate income and franchise tax return and paying

New Mexico, is on file that the corporation’s princi-

the amount of tax due for the net income of the PTE,

pal place of business is in New Mexico, or

through either estimated tax payments or withholding

•

If a corporation incorporated in New Mexico, the

tax payments.

corporation's incorporation papers are on file, with

sufficient portions of those papers to demonstrate

Important: Effective January 1, 2011, an owner may no

incorporation in New Mexico, or information from

longer use Form PTE-TA, New Mexico Non-resident Owner

the Public Regulation Commission web site indicat-

Income Tax Agreement, to avoid withholding from the net

ing that the corporation is a New Mexico corpora-

income of a PTE.

tion in good standing and its address, or

•

If an individual, a signed Form RPD-41354, Decla-

When is an agreement required:

For tax years beginning January 1, 2011, a PTE must remit

ration of Principal Place of Business or Residence

in New Mexico, is on file that the individual is a resi-

quarterly withholding from the net income of its owners,

dent of New Mexico and declaring the physical loca-

members or partners (owners) during the calendar quarter

tion of the individual's abode in New Mexico.

in which the net income was earned. Certain exceptions to

•

Documentation is on file showing that the owner is

the requirement to withhold are allowed, and documentation

granted exemption from the federal income tax by the

must be maintained in the PTE’s records to establish that the

United States Commissioner of Internal Revenue as an

PTE had reasonable cause for not withholding. To establish

organization described in Section 501(c)(3) of the In-

reasonable cause for not withholding, the PTE must be able

ternal Revenue Code, including a copy of the owner’s

to establish one of the following "Exceptions". The second

federal Form W-9, or a copy of the determination letter

bullet explains when the agreement may be used to avoid

from the IRS;

withholding from a PTE. If you are not required to be withheld

•

Documentation is on file showing that the owner is the

from because of one of the other reasons, contact the PTE.

United States, New Mexico or any agency, instrumental-

Exceptions to the requirement to withhold:

ity or political subdivision of either;

•

If the amount to be withheld from an owner's share of net

•

Documentation is on file showing that the owner is a

income in any calendar quarter is less than $30.00, no

federally recognized Indian nation, tribe or pueblo or any

withholding is required.

agency, instrumentality or political subdivision thereof;

•

At the option of a PTE, a PTE may agree with the owner

•

Documentation showing the PTE’s inability to make pay-

that the owner pay the amount that the PTE would have

ment of withholding from net income for the quarter due

been required to withhold and remit to the Department on

to non availability of cash or due to contracts and other

behalf of the owner pursuant to the Oil and Gas Proceeds

binding written covenants with unrelated third parties,

and Pass-Through Entity Withholding Tax Act. The pay-

unless cash payments have been made to any owner

ments by the owner may be remitted on Form RPD-41356,

during the quarter, in which case the PTE is liable for

payment of the withholding amount due up to the extent

Pass-Through Entity Owner's Quarterly Tax Payment,

and on the due date of this return, or by another form of

of the cash payment made during the quarter;

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3