Form Rpd-41356 - Pass-Through Entity Owner'S Quarterly Tax Payment - State Of New Mexico Taxation And Revenue Department Page 3

ADVERTISEMENT

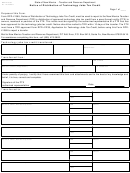

STATE OF NEW MEXICO

RPD-41356

Rev 07/18/2012

TAXATION AND REVENUE DEPARTMENT

Pass-Through Entity Owner's

Page 2 of 2

Quarterly Tax Payment Instructions

•

The PTE made a timely election for federal income

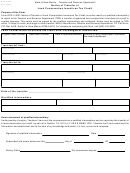

Line 2: Add penalty if the entity fails to file timely or to pay the

tax purposes that changes the net income of a pass-

amount on line 1 when due. Calculate the penalty by multiply-

through entity in a prior quarter is reasonable cause for

ing the unpaid amount on line 1 by 2%, then by the number

failure to withhold and deduct the required amounts on

of months or partial months for which the return or payment

the change in net income due to the election, or

is late, not to exceed 20% of the tax due. The penalty may

•

With respect to tax years 2014 through 2018, the PTE

not be less than $5.00.

has elected pursuant to 26 USC 108(i) to defer income

Line 3: Interest accrues daily on the unpaid principal of tax

from the discharge of indebtedness in conjunction with

due, and can change on a quarterly basis. The effective an-

the reacquisition after December 31, 2008 and before

nual and daily interest rates are posted on the Department's

January 1, 2011 of an applicable debt instrument for

web page at

or can be obtained by

the period 2014 through 2018 and the entity has insuf-

contacting the Department.

ficient cash to remit the withholding amount due on the

The formula for computing interest is:

deferred income reported in the year.

Tax Due x the daily interest rate for the quarter x number of

Additionally, certain adjustments to the amount of tax with-

days late = interest due.

held by the PTE are allowed.

For example, say a taxpayer owes $5,000 for the 1st quarter

of 2011, due April 25th, 2011. The daily interest rate for the

Adjustments to the amount withheld:

•

The amount of tax withheld from the owner's net income

2nd quarter of 2011 is 0.010958904% (annual rate 3%). If the

may be reduced, but not below zero, by the amount

tax-due date is April 25th, 2011, and he is paying on April 30th,

required to be withheld by a payor (remitter) for oil and

2011, the payment is 5 days late. Using the formula -- $5,000

gas proceeds, or

x 0.010958904 x 5 = 2.74.

•

If a PTE has deducted and withheld an amount pursuant

Line 4: Add lines 1, 2, and 3 to compute the total due. Enter

to the Oil and Gas Proceeds and Pass-Through Entity

the sum on line 4.

Withholding Tax Act, from the net income of an owner

Signature: The form is not complete until the owner or owner’s

that is also a PTE, the payee PTE may take credit for that

authorized agent has signed and dated the report. Enter the

amount in determining the amount the payee PTE must

e-mail address of the owner or owner's authorized agent.

withhold and deduct.

Amending: Check the amended indicator box if you are

INSTRUCTIONS FOR COMPLETING THIS FORM: Complete

amending a previously filed RPD-41356, Pass-Through Entity

all information requested. Round the tax amount in line 1 to

Owner’s Quarterly Tax Payment. If requesting a refund due to

the nearest whole dollar; for example; enter $10.49 as $10

an overpayment of tax withheld, complete Form RPD-41071,

and $10.50 as $11.

Application for Tax Refund, and submit it with the amended

Owner FEIN or SSN: Enter the owner's federal employer

return.

identification number (FEIN) or your social security number

File and pay the tax due online using the Department’s web

(SSN). Check the box to indicate whether the federal identi-

site at https://efile.state.nm.us. An owner filing this form for

fication number entered is a FEIN or SSN.

the first time, who has not previously filed any New Mexico

Owner name: Enter the name and mailing address of the owner

tax return to the Taxation and Revenue Department using the

of the PTE. Mark the box if the address is outside the U.S..

owner’s name and federal employer’s identification number

as shown on this form, will need to file this form by paper. If

Pass-through entity name: Enter the name of the PTE for

you have previously filed this form or any New Mexico tax

whom a withholding tax payment is made for the owner's

return, you are encouraged to file using the Department’s

share of the PTE’s net income.

web site. First-time filers will need to create a “Login Name”

Pass-through entity FEIN: Enter the federal identification

and “Password”. If you need additional information regarding

number (FEIN) of the PTE for whom a withholding tax pay-

forms or instructions, please visit .

ment is made for the owner's share of the PTE's net income.

If you cannot electronically file, you may submit this form to:

Quarterly report period: Enter a quarterly report period that

New Mexico Taxation and Revenue Department, P.O. Box

is based on a calendar quarter. Enter the month, day and year

25127, Santa Fe, NM 87504-5127. Make the check or money

of the first and last day of the calendar quarter for which you

order payable to New Mexico Taxation and Revenue Depart-

are reporting. For example, if filing for the first quarter of 2011,

ment. Indicate “PTW-O” and enter the owner's FEIN or SSN

enter 01-01-11 to 03-31-11 in the space provided.

on the payment. PTW-O payments should not be sent with

any other payments to the Department.

Line 1: Enter the amount of tax to be withheld during the

quarterly report period. The PTE should provide you with the

For assistance call (505) 827-0825.

amount of withholding tax to be paid.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3