Form Pit-8453 - Individual Income Tax Declaration For Electronic Filing And Transmittal - State Of New Mexico Taxation And Revenue Department Page 3

ADVERTISEMENT

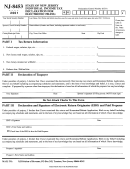

STATE OF NEW MEXICO TAXATION AND REVENUE DEPARTMENT

ACD-31012 12

INDIVIDUAL INCOME TAX DECLARATION FOR

Rev. 12/13/2012

ELECTRONIC FILING AND TRANSMITTAL

PIT-8453

For the year January 1 - December 31, 2012

INSTRUCTIONS

Page 2 of 2

gas wells located in New Mexico;

Supporting Paper Documentation Required to be Submit-

• Form RPD-41359, Annual Statement of Pass-Through Entity

ted to the Department:

Withholding, if tax was withheld from the net income of a pass-

You must submit Form PIT-8453 if any of the following sup-

through entity;

porting documentation is required by instruction:

• A schedule of net operating loss carry-forward if you are

claiming a New Mexico net operating loss;

• An IRS approval for an ITIN if you or your spouse are using an

• Required documentation to support your claim for any refundable

ITIN instead of an SSN for the first time;

or non-refundable credits on Schedules PIT-RC or PIT-CR;

• A federal non-resident return if you are filing a married-filing-

• Form PIT-4 - Cultural Properties Preservation Credit;

jointly return and your spouse is not required to obtain an SSN

• Form PIT-5 - Qualified Business Facility Rehabilitation Credit;

or an ITIN per federal regulation;

• Form RPD-41243 - Rural Job Tax Credit;

• A statement of Division of Community and Separate Income

• Form RPD-41244 - Technology Jobs Tax Credit;

and Payments if you are (1) married filing separate returns, and

• Form RPD-41246 - Electronic Card-Reading Equipment Tax Credit;

your income and payments are not divided evenly, or (2) married

• Forms RPD-41280 & 41281 - Job Mentorship Tax Credit;

filing a joint return and you or your spouse - but not both - is a

• Form RPD-41282 - Land Conservation Incentives Credit;

resident of a community property state, and your income and

• Form RPD-41301 - Affordable Housing Tax Credit;

payments are not divided evenly;

• Form RPD-41317 - Solar Market Development Tax Credit;

• Form RPD-41083, Affidavit to Obtain Refund of New Mexico

• Form RPD-41340 - Blended Biodiesel Fuel Tax Credit;

Tax Due a Deceased Taxpayer, if a refund must be made payable

• Form RPD-41329 - Sustainable Building Tax Credit;

to the order of a person other than a deceased primary taxpayer

• Form RPD-41320 - Angel Investment Credit;

or spouse;

• Form RPD-41326 - Rural Health Care Practitioners Tax Credit;

• A copy of a death certificate if the primary taxpayer or spouse

• Form RPD-41319 - Agricultural Water Conservation Tax Credit;

named on the return died before filing the return;

• Form RPD-41334 - Advanced Energy Tax Credit;

• A property tax statement for Los Alamos or Santa Fe County

• Form RPD-41346 - Geothermal Ground-Coupled Heat Pump Tax Credit;

Property if you are claiming the additional low income property

• Form RPD-41361 - Agricultural Biomass Tax Credit;

tax rebate for Los Alamos or Santa Fe counties on Schedule

• Form RPD-41228 - Film Production Tax Credit;

PIT-RC, and the PIT-1 return shows an address not located in

• Form RPD-41358 - Cancer Clinical Trial Tax Credit; or

Los Alamos or Santa Fe County;

• Form RPD-41371 - Veterans' Employment Tax Credit.

• Another state's tax return if claiming the credit for taxes paid

to another state;

• Any other paper schedules or attachments required by instruc-

• Form PIT-CG, Caregiver's Statement and the Day Care Credit

tion.

Worksheet, when claiming the child day care credit on Schedule

PIT-RC

Amended Returns:

• Form PIT-110, Adjustments to New Mexico Income Worksheet,

You may also use this form to submit back-up documentation

if you are a non-resident whose job is located in this state, but

for amended returns. For an amended return, you are required

whose job assignments require you to be temporarily assigned

to submit corrected annual information returns and statements

outside of New Mexico;

of withholding, applicable federal forms and schedules, and

• Certification from the Human Services Department or a

letters of explanation, if required.

licensed child placement agency, in the first year in which a

Special Needs Adopted Child Tax Credit is claimed.

• Schedule CC, Alternative Tax Schedule, if you are a non-

resident who qualifies to pay using an alternative tax method;

• Form RPD-41272, Calculation of Estimated Personal Income

Tax Underpayment Penalty, if you owe penalty for underpayment

of estimated personal income tax and elect to use an alterna-

tive method, and not the standard method, of computing your

liability;

• Form RPD-41285, Annual Statement of Withholding of Oil

& Gas Proceeds, if tax was withheld from proceeds from oil or

When required, mail Form PIT-8453 and attachments to:

New Mexico Taxation and Revenue Department

P.O. Box 5418

Santa Fe, NM 87502-5418

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3