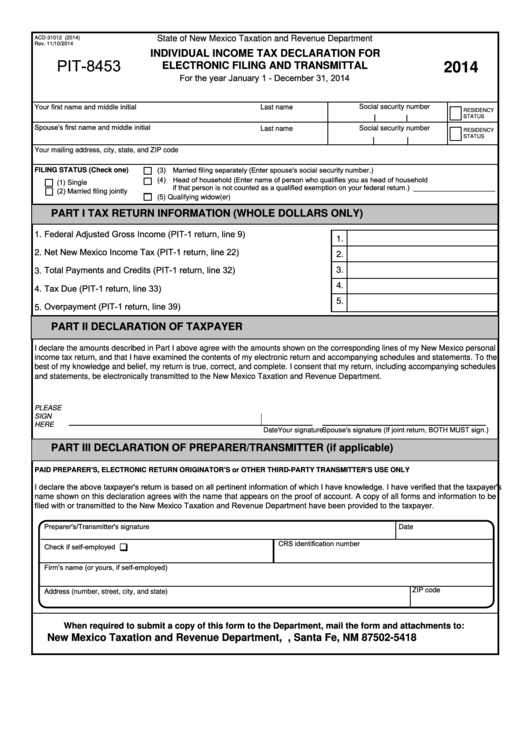

State of New Mexico Taxation and Revenue Department

ACD-31012 (2014)

Rev. 11/10/2014

INDIVIDUAL INCOME TAX DECLARATION FOR

PIT-8453

ELECTRONIC FILING AND TRANSMITTAL

2014

For the year January 1 - December 31, 2014

Social security number

Your first name and middle initial

Last name

RESIDENCY

STATUS

Spouse's first name and middle initial

Social security number

Last name

RESIDENCY

STATUS

Your mailing address, city, state, and ZIP code

(3) Married filing separately (Enter spouse's social security number.)

FILING STATUS (Check one)

(4) Head of household (Enter name of person who qualifies you as head of household

(1) Single

if that person is not counted as a qualified exemption on your federal return.) _____________________

(2) Married filing jointly

(5) Qualifying widow(er)

PART I

TAX RETURN INFORMATION (WHOLE DOLLARS ONLY)

1.

Federal Adjusted Gross Income (PIT-1 return, line 9) ................................

1.

Net New Mexico Income Tax (PIT-1 return, line 22) ...................................

2.

2.

3.

3.

Total Payments and Credits (PIT-1 return, line 32).....................................

4.

4.

Tax Due (PIT-1 return, line 33) ...................................................................

5.

Overpayment (PIT-1 return, line 39) ...........................................................

5.

PART II

DECLARATION OF TAXPAYER

I declare the amounts described in Part I above agree with the amounts shown on the corresponding lines of my New Mexico personal

income tax return, and that I have examined the contents of my electronic return and accompanying schedules and statements. To the

best of my knowledge and belief, my return is true, correct, and complete. I consent that my return, including accompanying schedules

and statements, be electronically transmitted to the New Mexico Taxation and Revenue Department.

PLEASE

SIGN

HERE

Your signature

Date

Spouse's signature (If joint return, BOTH MUST sign.)

PART III

DECLARATION OF PREPARER/TRANSMITTER (if applicable)

PAID PREPARER'S, ELECTRONIC RETURN ORIGINATOR'S or OTHER THIRD-PARTY TRANSMITTER'S USE ONLY

I declare the above taxpayer's return is based on all pertinent information of which I have knowledge. I have verified that the taxpayer's

name shown on this declaration agrees with the name that appears on the proof of account. A copy of all forms and information to be

filed with or transmitted to the New Mexico Taxation and Revenue Department have been provided to the taxpayer.

Preparer's/Transmitter's signature

Date

CRS identification number

Check if self-employed

Firm's name (or yours, if self-employed)

ZIP code

Address (number, street, city, and state)

When required to submit a copy of this form to the Department, mail the form and attachments to:

New Mexico Taxation and Revenue Department, P.O. Box 5418, Santa Fe, NM 87502-5418

1

1 2

2 3

3