Form Crs-1 - Reporting Gross Receipts, Withholding And Compensating Taxes - 2013

ADVERTISEMENT

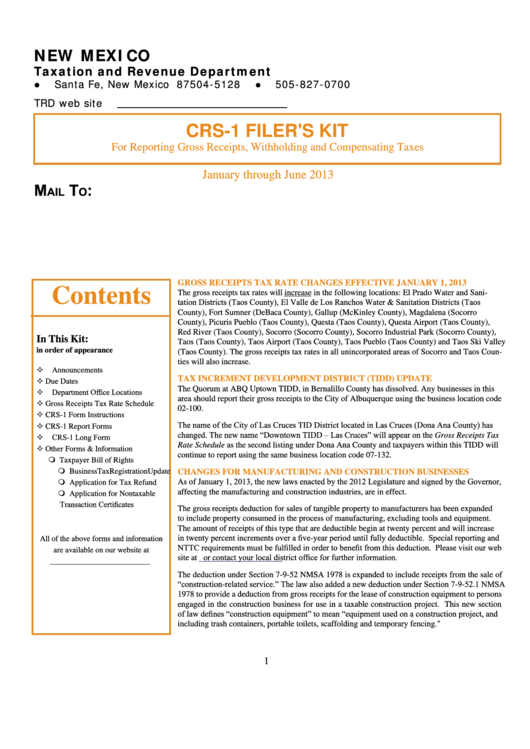

NEW MEXICO

Taxation and Revenue Department

P.O. Box 25128

Santa Fe, New Mexico 87504-5128

505-827-0700

l

l

TRD web site

CRS-1 FILER'S KIT

For Reporting Gross Receipts, Withholding and Compensating Taxes

January through June 2013

M

T

:

ail

o

GROSS RECEIPTS TAX RATE CHANGES EFFECTIVE JANUARY 1, 2013

Contents

The gross receipts tax rates will increase in the following locations: El Prado Water and Sani-

tation Districts (Taos County), El Valle de Los Ranchos Water & Sanitation Districts (Taos

County), Fort Sumner (DeBaca County), Gallup (McKinley County), Magdalena (Socorro

County), Picuris Pueblo (Taos County), Questa (Taos County), Questa Airport (Taos County),

Red River (Taos County), Socorro (Socorro County), Socorro Industrial Park (Socorro County),

In This Kit:

Taos (Taos County), Taos Airport (Taos County), Taos Pueblo (Taos County) and Taos Ski Valley

in order of appearance

(Taos County). The gross receipts tax rates in all unincorporated areas of Socorro and Taos Coun-

ties will also increase.

—

Announcements

TAX INCREMENT DEVELOPMENT DISTRICT (TIDD) UPDATE

—

Due Dates

The Quorum at ABQ Uptown TIDD, in Bernalillo County has dissolved. Any businesses in this

— Department Office Locations

area should report their gross receipts to the City of Albuquerque using the business location code

—

Gross Receipts Tax Rate Schedule

02-100.

—

CRS-1 Form Instructions

The name of the City of Las Cruces TID District located in Las Cruces (Dona Ana County) has

—

CRS-1 Report Forms

changed. The new name “Downtown TIDD – Las Cruces” will appear on the Gross Receipts Tax

— CRS-1 Long Form

Rate Schedule as the second listing under Dona Ana County and taxpayers within this TIDD will

—

Other Forms & Information

continue to report using the same business location code 07-132.

Taxpayer Bill of Rights

Business Tax Registration Update

CHANGES FOR MANUFACTURING AND CONSTRUCTION BUSINESSES

As of January 1, 2013, the new laws enacted by the 2012 Legislature and signed by the Governor,

Application for Tax Refund

affecting the manufacturing and construction industries, are in effect.

Application for Nontaxable

Transaction Certificates

The gross receipts deduction for sales of tangible property to manufacturers has been expanded

to include property consumed in the process of manufacturing, excluding tools and equipment.

The amount of receipts of this type that are deductible begin at twenty percent and will increase

in twenty percent increments over a five-year period until fully deductible. Special reporting and

All of the above forms and information

NTTC requirements must be fulfilled in order to benefit from this deduction. Please visit our web

are available on our website at

site at or contact your local district office for further information.

.

The deduction under Section 7-9-52 NMSA 1978 is expanded to include receipts from the sale of

“construction-related service.” The law also added a new deduction under Section 7-9-52.1 NMSA

1978 to provide a deduction from gross receipts for the lease of construction equipment to persons

engaged in the construction business for use in a taxable construction project. This new section

of law defines “construction equipment” to mean “equipment used on a construction project, and

including trash containers, portable toilets, scaffolding and temporary fencing."

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30