Form Rpd-41229 - Application For Film Production Tac Credit - State Of New Mexico Taxation And Revenue Department

ADVERTISEMENT

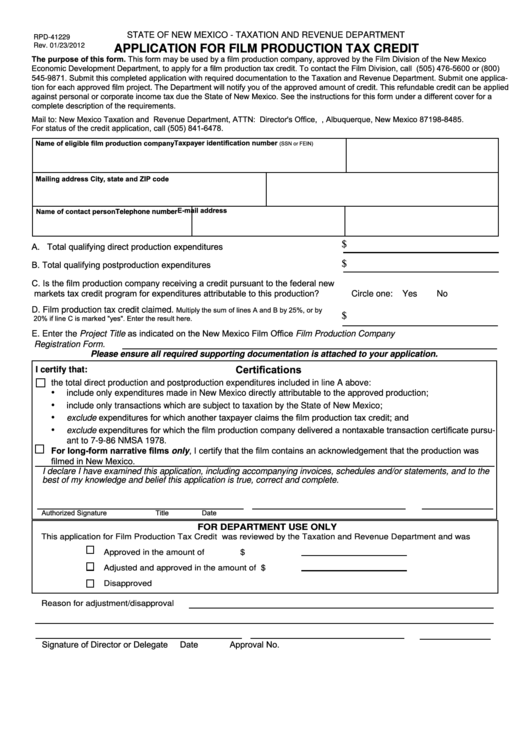

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

RPD-41229

Rev. 01/23/2012

APPLICATION FOR FILM PRODUCTION TAX CREDIT

The purpose of this form. This form may be used by a film production company, approved by the Film Division of the New Mexico

Economic Development Department, to apply for a film production tax credit. To contact the Film Division, call (505) 476-5600 or (800)

545-9871. Submit this completed application with required documentation to the Taxation and Revenue Department. Submit one applica-

tion for each approved film project. The Department will notify you of the approved amount of credit. This refundable credit can be applied

against personal or corporate income tax due the State of New Mexico. See the instructions for this form under a different cover for a

complete description of the requirements.

Mail to: New Mexico Taxation and Revenue Department, ATTN: Director's Office, P.O. Box 8485, Albuquerque, New Mexico 87198-8485.

For status of the credit application, call (505) 841-6478.

Name of eligible film production company

Taxpayer identification number

(SSN or FEIN)

Mailing address

City, state and ZIP code

E-mail address

Name of contact person

Telephone number

$

A. Total qualifying direct production expenditures .............................................

B. Total qualifying postproduction expenditures ................................................

$

C. Is the film production company receiving a credit pursuant to the federal new

markets tax credit program for expenditures attributable to this production?

Circle one:

Yes

No

D. Film production tax credit claimed.

Multiply the sum of lines A and B by 25%, or by

$

20% if line C is marked "yes". Enter the result here. ..................................................................

E. Enter the Project Title as indicated on the New Mexico Film Office Film Production Company

Registration Form.

Please ensure all required supporting documentation is attached to your application.

Certifications

I certify that:

the total direct production and postproduction expenditures included in line A above:

•

include only expenditures made in New Mexico directly attributable to the approved production;

•

include only transactions which are subject to taxation by the State of New Mexico;

•

exclude expenditures for which another taxpayer claims the film production tax credit; and

•

exclude expenditures for which the film production company delivered a nontaxable transaction certificate pursu-

ant to 7-9-86 NMSA 1978.

For long-form narrative films only, I certify that the film contains an acknowledgement that the production was

filmed in New Mexico.

I declare I have examined this application, including accompanying invoices, schedules and/or statements, and to the

best of my knowledge and belief this application is true, correct and complete.

Authorized Signature

Title

Date

FOR DEPARTMENT USE ONLY

This application for Film Production Tax Credit was reviewed by the Taxation and Revenue Department and was

Approved in the amount of

$

Adjusted and approved in the amount of

$

Disapproved

Reason for adjustment/disapproval

Signature of Director or Delegate

Date

Approval No.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1