Form Rpd-41300 - Services For Resale Tax Credit - State Of New Mexico Taxation And Revenue Department Page 2

ADVERTISEMENT

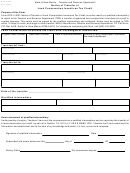

RPD-41300

State of New Mexico - Taxation and Revenue Department

Rev. 02/2011

SERVICES FOR RESALE TAX CREDIT

INSTRUCTIONS

WHAT SERVICES QUALIFY

A seller may claim a services for resale tax credit only if:

•

the buyer resells the service in the ordinary course of business,

•

the resale is not subject to the gross receipts tax or the governmental gross receipts tax, and

•

the buyer delivers to the seller Form RPD-41305, Declaration of Services Purchased For Resale, completed and

signed by the buyer.

A seller may not claim the credit for services to a governmental entity or to a person who is a prime contractor that oper-

ates a facility in New Mexico designated as a national laboratory by an act of congress.

NOTE: The service must be resold and may not be consumed in the ordinary course of business.

HOW TO COMPLETE THIS FORM

Complete all information requested in the business name block. The reported tax period must match the tax period shown

on the CRS-1 return for which you are reporting the eligible sales.

Columns 1 and 2: Complete Columns 1 and 2 using the CRS-1 Instructions for Columns A Through H. The Gross Receipts

Tax Rate Schedule has the listing of counties, municipalities and location codes for each.

Column 3: Enter only that portion of gross receipts from Column D of your CRS-1 report for the current report which is

attributable to the receipts of sales of services for resale as described. Do not include receipts from other sales. Exclude

from gross receipts reported in Column 3 any gross receipts tax, governmental gross receipts tax and leased vehicle gross

receipts tax.

Column 4: Multiply the amount reported in Column 3 by 10%.

Complete either Column 5 or Column 6. Complete Column 5 if the reported business location is within a municipality. Com-

plete Column 6 if the reported business location is a county business located outside a municipality.

Column 5: If the business is located within a municipality, multiply Column 4 by 0.03775 (3.775%).

Column 6: If the business is located within the remainder of a county, multiply Column 4 by 0.05 (5%).

Line A

Column 5: Enter the sum of Column 5, services for resale tax credit attributable to municipal business locations.

Column 6: Enter the sum of Column 6, services for resale tax credit attributable to county business locations.

Line B

Enter the sum of Line A, Columns 5 and 6.

HOW TO CLAIM THIS CREDIT

To claim a services for resale tax credit, you must file the full-page version of the New Mexico Form CRS-1. Complete the

CRS-1 Long Form and supplemental forms, if any, according to the instructions. Do not reduce the tax liability on the CRS-1

Long Form to reflect the services for resale tax credit claimed. Instead, underpay the tax liability shown on the return by the

amount of services for resale tax credit claimed. Do not enter a negative number. You may take this credit only if there is tax

due for the current report period. See the example below.

Example: Company X sells a qualifying service for resale and obtains Form RPD-41305, Declaration of Services Purchased

for Resale, from the buyer. X’s CRS-1 Long Form indicates that the total gross receipts tax due from the sale is $1,000 and

is reported on lines 1, 4 and 7. The business is located in Santa Fe county, outside the boundries of a municipality. The ser-

vices for resale tax credit computes to $5, and the taxpayer is taking the credit against those sales. The taxpayer submits a

CRS-1 Long Form indicating that $1,000 is due. The taxpayer attaches Form RPD-41300, Services for Resale Tax Credit,

indicating a $5 tax credit is claimed and includes a payment for the difference of $95.

IMPORTANT: You must retain in your records the Form RPD-41305, Declaration of Services Purchased for Resale, signed

by the buyer as documentation acceptable on audit for this credit.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2