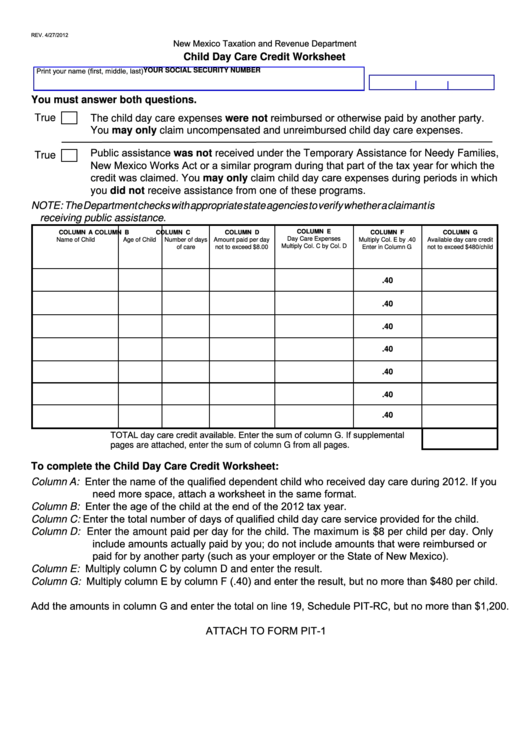

Child Day Care Credit Worksheet Form - New Mexico Taxation And Revenue Department

ADVERTISEMENT

REV. 4/27/2012

New Mexico Taxation and Revenue Department

Child Day Care Credit Worksheet

Print your name (first, middle, last)

YOUr SOCiAL SECUriTY NUMBEr

You must answer both questions.

The child day care expenses were not reimbursed or otherwise paid by another party.

True

You may only claim uncompensated and unreimbursed child day care expenses.

Public assistance was not received under the Temporary Assistance for Needy Families,

True

New Mexico Works Act or a similar program during that part of the tax year for which the

credit was claimed. You may only claim child day care expenses during periods in which

you did not receive assistance from one of these programs.

NOTE: The Department checks with appropriate state agencies to verify whether a claimant is

receiving public assistance.

COLUMN E

COLUMN A

COLUMN B

COLUMN C

COLUMN D

COLUMN F

COLUMN G

Day Care Expenses

Name of Child

Age of Child

Number of days

Amount paid per day

Multiply Col. E by .40

Available day care credit

Multiply Col. C by Col. D

of care

not to exceed $8.00

Enter in Column G

not to exceed $480/child

.40

.40

.40

.40

.40

.40

.40

TOTAL day care credit available. Enter the sum of column G. If supplemental

pages are attached, enter the sum of column G from all pages.

To complete the Child Day Care Credit Worksheet:

Enter the name of the qualified dependent child who received day care during 2012. If you

Column A:

need more space, attach a worksheet in the same format.

Enter the age of the child at the end of the 2012 tax year.

Column B:

Enter the total number of days of qualified child day care service provided for the child.

Column C:

Column D:

Enter the amount paid per day for the child. The maximum is $8 per child per day. Only

include amounts actually paid by you; do not include amounts that were reimbursed or

paid for by another party (such as your employer or the State of New Mexico).

Column E:

Multiply column C by column D and enter the result.

Multiply column E by column F (.40) and enter the result, but no more than $480 per child.

Column G:

Add the amounts in column G and enter the total on line 19, Schedule PIT-RC, but no more than $1,200.

ATTACH TO FORM PIT-1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1