Form Rpd-41373 - Application For Refund Of Tax Withheld From Pass-Through Entities - New Mexico Taxation And Revenue Department Page 2

ADVERTISEMENT

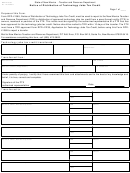

RPD-41373

New Mexico Taxation and Revenue Department

Int. 12/04/2012

Application for Refund of Tax Withheld From Pass-Through Entities

- Instructions -

Who May Use This Form: A pass-through entity (PTE) who is

Completing This Form: A valid claim for refund requires all

subject to withholding tax from its owners, partners, members

information requested on this form. “Basis for Refund” means

or beneficiaries (owners) net income according to the Oil and

a brief statement of the facts on which the claim is based, and

Gas Proceeds and Pass-Through Entity Withholding Tax Act,

must explain why the overpayment was made. Do not merely

may use this form to request a refund of tax withheld against

enter the word “overpayment”. Attach a letter of explanation if

the net income it receives from another PTE, reported on

the space provided is insufficient. The application for refund

Form PTE, New Mexico Information Return for Pass-Through

must be signed by the PTE’s owner or the PTE’s authorized

Entities, or an overpayment of withholding tax paid and reported

representative.

on Form RPD-41367, Annual Withholding of Net Income From

a Pass-Through Entity Detail Report.

IMPORTANT: To validate the claim for refund, the Department

may require both Form PTE, New Mexico Information Return

For filers of Form PTE, New Mexico Information Return for

for Pass-Through Entities, and Form RPD-41367, Annual

Pass-Through Entities. If you have received a 1099-Misc,

Withholding of Net Income From a Pass-Through Entity

Form RPD-41359, Annual Statement of Pass-Through

Detail Report, to be filed. The Department may be required

Entity Withholding, or Form RPD-41285, Annual Statement

to compare the information provided on both forms to verify

of Withholding of Oil and Gas Proceeds, showing income

that the claim for refund is valid.

tax withheld on the net income of the pass-through entity or

withholding on New Mexico oil and gas proceeds received,

Request for Direct Deposit: The refund of tax may be

and you wish to obtain a refund of the tax withheld, then you

deposited directly into your bank account by completing all

must submit a completed Form RPD-41373, Application for

information within the Direct Deposit section of this form. If

Refund of Tax Withheld From Pass-Through Entities, to the

the information is incomplete or incorrect, your refund will be

Department. The forms 1099-Misc, RPD-41359, or RPD-41285

mailed.

must be issued to the PTE.

Important: A direct deposit of your refund may not be made

When requesting a refund, attach Form RPD-41373 to the

to a bank account located at a financial institution outside the

PTE return and submit it to the address for filing the PTE

territorial jurisdiction of the United States. In order to com-

return. The applicable address is the address listed at the

ply with new federal banking rules, anyone wishing to have

bottom of this page.

your refund directly deposited into your account, you must

answer an additional question when completing the Direct

For filers of Form RPD-41367, Annual Withholding of Net

Deposit portion of your application for tax refund. If you do

Income From a Pass-Through Entity Detail Report. If you have

not answer the question, your refund will be mailed to you in

overpaid the tax to be withheld from the owners allocable net

the form of a paper check. If you answer the question incor-

income of a PTE on Form RPD-41367, Annual Withholding

rectly, your refund may be delayed, rejected or frozen by the

of Net Income From a Pass-Through Entity Detail Report,

National Automated Clearing House Association (NACHA)

you must amend Form RPD-41367 and submit a completed

or the Office of Foreign Assets Control (OFAC). You will be

Form RPD-41373, Application for Refund of Tax Withheld

asked whether the refund will go to, or through, an account

From Pass-Through Entities, to the Department. If the PTE

located outside the territorial jurisdiction of the United States.

overpaid the tax by filing Form RPD-41355, Pass-Through

You will be advised if the answer is “yes”, you should not

Entity Withholding Tax Return, then the PTE must amend

choose the Direct Deposit method of delivering your refund.

Form RPD-41355, and indicate that Form RPD-41355 was

Your options are to use a different bank account or to leave

amended in the “Basis for Refund” portion of this form. Form

the Direct Deposit portion of the application blank and have

RPD-41373, Application for Refund of Tax Withheld From Pass-

a paper check mailed to the address on the taxpayer’s re-

Through Entities, may be submitted separately if amending

cords. A financial institution is located within the territorial

these forms online.

jurisdiction of the United States if it is located within the United

States; located on a United States military base, or located

When requesting a refund, submit the completed Form RPD-

in American Samoa, Guam, the Northern Mariana Islands,

41373 to the address at the bottom of this page.

Puerto Rico or the U.S. Virgin Islands.

New Mexico Taxation and Revenue Department

P.O. Box 25127

Santa Fe, NM 87504-5127

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2