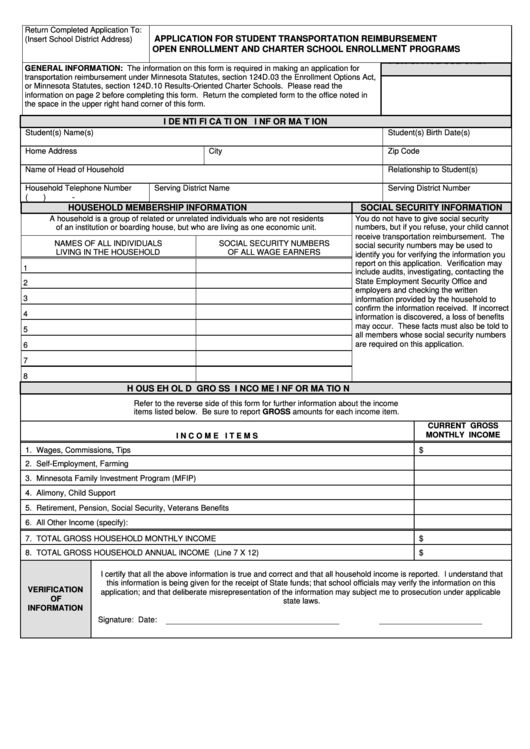

Application For Student Transportation Reimbursement

ADVERTISEMENT

Return Completed Application To:

A P P L I C A T I O N F O R S T U D E N T T R A N S P O R T A T I O N R E I M B U R S E M E N T

(Insert School District Address)

NT

O P E N EN RO L LM ENT AN D CH ART E R S CHO O L EN RO LLM E

PR O G R AM S

GENERAL INFORMATION: The information on this form is required in making an application for

FO R O FF IC E U S E O N LY

transportation reimbursement under Minnesota Statutes, section 124D.03 the Enrollment Options Act,

or Minnesota Statutes, section 124D.10 Results-Oriented Charter Schools. Please read the

information on page 2 before completing this form. Return the completed form to the office noted in

the space in the upper right hand corner of this form.

I D E N T I F I C A T I O N

I N F O R M A T I O N

Student(s) Name(s)

Student(s) Birth Date(s)

Home Address

City

Zip Code

Name of Head of Household

Relationship to Student(s)

Household Telephone Number

Serving District Name

Serving District Number

(

)

-

H O U S E H O L D M E M B E R S H I P I N F O R M A T I O N

SOCIAL SECURITY INFORMATION

A household is a group of related or unrelated individuals who are not residents

You do not have to give social security

of an institution or boarding house, but who are living as one economic unit.

numbers, but if you refuse, your child cannot

receive transportation reimbursement. The

NAMES OF ALL INDIVIDUALS

SOCIAL SECURITY NUMBERS

social security numbers may be used to

LIVING IN THE HOUSEHOLD

OF ALL WAGE EARNERS

identify you for verifying the information you

report on this application. Verification may

1

include audits, investigating, contacting the

State Employment Security Office and

2

employers and checking the written

3

information provided by the household to

confirm the information received. If incorrect

4

information is discovered, a loss of benefits

may occur. These facts must also be told to

5

all members whose social security numbers

are required on this application.

6

7

8

H O U S E H O L D G R O S S I N C O M E I N F O R M A T I O N

Refer to the reverse side of this form for further information about the income

items listed below. Be sure to report GROSS amounts for each income item.

CURRENT GROSS

MONTHLY INCOME

I N C O M E I T E M S

1. Wages, Commissions, Tips

$

2. Self-Employment, Farming

3. Minnesota Family Investment Program (MFIP)

4. Alimony, Child Support

5. Retirement, Pension, Social Security, Veterans Benefits

6. All Other Income (specify):

7. T O T A L G R O S S H O U S E H O L D M O N T H L Y I N C O M E

$

8. T O T A L G R O S S H O U S E H O L D A N N U A L I N C O M E

( L i n e 7 X 1 2 )

$

I certify that all the above information is true and correct and that all household income is reported. I understand that

this information is being given for the receipt of State funds; that school officials may verify the information on this

VERIFICATION

application; and that deliberate misrepresentation of the information may subject me to prosecution under applicable

OF

state laws.

INFORMATION

Signature:

Date:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2