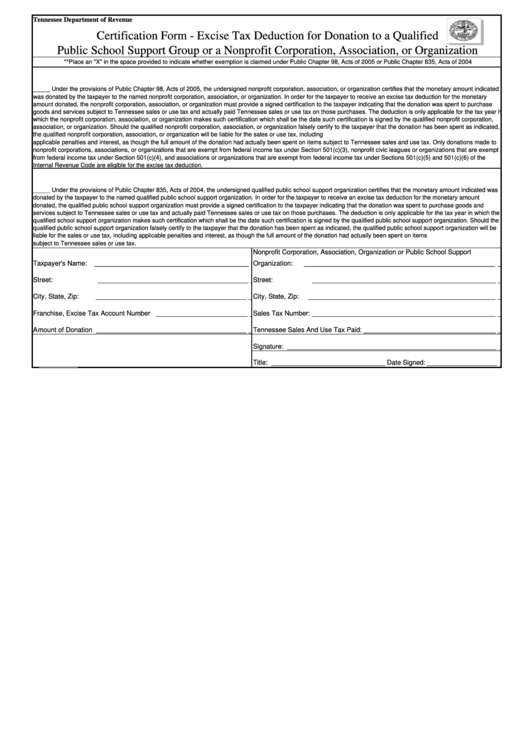

Tennessee Department of Revenue

Certification Form - Excise Tax Deduction for Donation to a Qualified

Public School Support Group or a Nonprofit Corporation, Association, or Organization

**Place an "X" in the space provided to indicate whether exemption is claimed under Public Chapter 98, Acts of 2005 or Public Chapter 835, Acts of 2004

_____ Under the provisions of Public Chapter 98, Acts of 2005, the undersigned nonprofit corporation, association, or organization certifies that the monetary amount indicated

was donated by the taxpayer to the named nonprofit corporation, association, or organization. In order for the taxpayer to receive an excise tax deduction for the monetary

amount donated, the nonprofit corporation, association, or organization must provide a signed certification to the taxpayer indicating that the donation was spent to purchase

goods and services subject to Tennessee sales or use tax and actually paid Tennessee sales or use tax on those purchases. The deduction is only applicable for the tax year in

which the nonprofit corporation, association, or organization makes such certification which shall be the date such certification is signed by the qualified nonprofit corporation,

association, or organization. Should the qualified nonprofit corporation, association, or organization falsely certify to the taxpayer that the donation has been spent as indicated,

the qualified nonprofit corporation, association, or organization will be liable for the sales or use tax, including

applicable penalties and interest, as though the full amount of the donation had actually been spent on items subject to Tennessee sales and use tax. Only donations made to

nonprofit corporations, associations, or organizations that are exempt from federal income tax under Section 501(c)(3), nonprofit civic leagues or organizations that are exempt

from federal income tax under Section 501(c)(4), and associations or organizations that are exempt from federal income tax under Sections 501(c)(5) and 501(c)(6) of the

Internal Revenue Code are eligible for the excise tax deduction.

_____ Under the provisions of Public Chapter 835, Acts of 2004, the undersigned qualified public school support organization certifies that the monetary amount indicated was

donated by the taxpayer to the named qualified public school support organization. In order for the taxpayer to receive an excise tax deduction for the monetary amount

donated, the qualified public school support organization must provide a signed certification to the taxpayer indicating that the donation was spent to purchase goods and

services subject to Tennessee sales or use tax and actually paid Tennessee sales or use tax on those purchases. The deduction is only applicable for the tax year in which the

qualified school support organization makes such certification which shall be the date such certification is signed by the qualified public school support organization. Should the

qualified public school support organization falsely certify to the taxpayer that the donation has been spent as indicated, the qualified public school support organization will be

liable for the sales or use tax, including applicable penalties and interest, as though the full amount of the donation had actually been spent on items

subject to Tennessee sales or use tax.

Nonprofit Corporation, Association, Organization or Public School Support

Taxpayer's Name:

___________________________________________

Organization:

_____________________________________________________

Street:

__________________________________________

Street:

___________________________________________________

City, State, Zip:

__________________________________________City, State, Zip:

____________________________________________________

Franchise, Excise Tax Account Number __________________________Sales Tax Number: ___________________________________________________

Amount of Donation __________________________________________

Tennessee Sales And Use Tax Paid: _____________________________________

Signature: __________________________________________________________

Title: _______________________________ Date Signed: ____________________

1

1