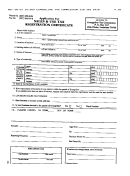

INSTRUCTIONS FOR COMPLETING APPLICATION FOR REGISTRATION

Tenn. Code Ann. Section 67-4-2004(20) expands the types of businesses subject to Franchise, Excise tax by defining “person”

or “taxpayer” to include in addition to corporations; limited liability companies, limited liability partnerships, limited partnerships,

and any other organization or entity engaged in business. It excludes sole proprietorships and general partnerships.

Tenn. Code Ann. Sections 67-4-2003(c) and 67-4-2103(c) require taxpayers subject to the Franchise, Excise tax to register with

the Department of Revenue within 60 days of 7/1/99 or within 15 days after becoming subject to the tax, whichever date occurs

last.

Proper completion of the application will insure the timely and correct establishment of the Franchise, Excise tax registration

for your business. This application should be mailed to the Tennessee Department of Revenue, 500 Deaderick Street,

Nashville, TN 37242 or faxed to (615) 741-0682.

ABOUT THE APPLICATION

ITEM 1

YOU MUST PROVIDE THE LEGAL NAME AND LOCATION ADDRESS.

ITEM 2

IF MAILING ADDRESS IS DIFFERENT THAN LOCATION ADDRESS, PLEASE PROVIDE.

ITEM 3

You must include a business phone number where you can be reached during normal business hours. Include

a business fax number if applicable.

ITEM 4

You must provide the business’ fiscal year end. This should be the same year end that is used for filing the

federal return.

ITEM 5

YOU MUST PROVIDE THE BUSINESS’ FEDERAL EMPLOYER’S IDENTIFICATION NUMBER.

ITEM 6

You must check the appropriate boxes which pertain to the ownership of your business.

ITEM 7

You must provide the SOS Control No., if the business is registered with the Tennessee Secretary of State.

ITEM 8

If registering as a Series LLC, provide the following information for the Master LLC on a separate sheet: Federal EIN,

Entity Name, Location Address, Telephone Number, and State of Domestic Certificate of Authority.

ITEM 9

If a limited partnership, limited liability partnership, or limited liability company; did one or more corporations

subject to Tennessee tax, directly or indirectly, have in the aggregate 80% or more ownership interest at any

time after 6/30/98, please answer Yes or No.

ITEM 10

You must identify owners, officers, partners, or members and you must enter social security numbers or FEINs,

address and telephone number and PERCENTAGE OF OWNERSHIP for principal owners, partners, mem-

bers, or corporate officers.

ITEM 11

THIS APPLICATION MUST BE SIGNED BY A PARTNER, LLC MEMBER, OR A CORPORATE OFFICER OF

THE BUSINESS. Do not print or use a signature stamp.

If you need assistance in completing this application, Tennessee residents may call in-state toll-free (800) 342-1003; out-of-

state callers may dial (615) 253-0600.

1

1 2

2