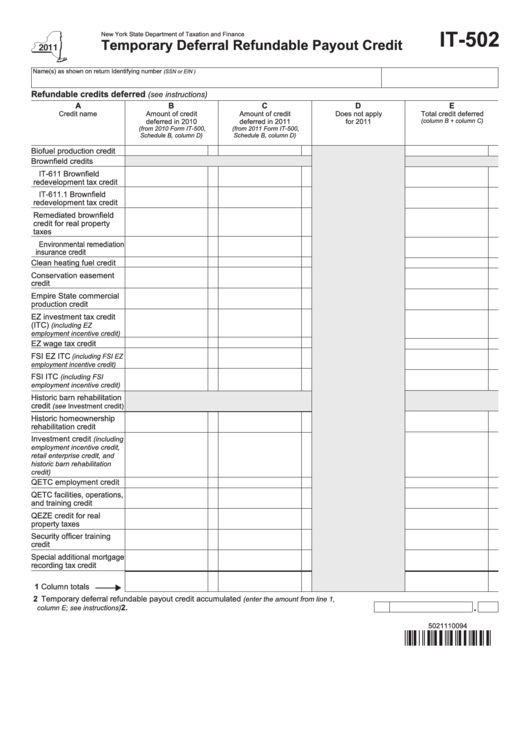

IT-502

New York State Department of Taxation and Finance

Temporary Deferral Refundable Payout Credit

Name(s) as shown on return

Identifying number

(SSN or EIN )

Refundable credits deferred

(see instructions)

A

B

C

D

E

Credit name

Amount of credit

Amount of credit

Does not apply

Total credit deferred

deferred in 2010

deferred in 2011

for 2011

(column B + column C)

(from 2010 Form IT-500,

(from 2011 Form IT-500,

Schedule B, column D)

Schedule B, column D)

Biofuel production credit

Brownfield credits

IT-611 Brownfield

redevelopment tax credit

IT-611.1 Brownfield

redevelopment tax credit

Remediated brownfield

credit for real property

taxes

Environmental remediation

insurance credit

Clean heating fuel credit

Conservation easement

credit

Empire State commercial

production credit

EZ investment tax credit

(ITC)

(including EZ

employment incentive credit)

EZ wage tax credit

FSI EZ ITC

(including FSI EZ

employment incentive credit)

FSI ITC

(including FSI

employment incentive credit)

Historic barn rehabilitation

credit

(see Investment credit)

Historic homeownership

rehabilitation credit

Investment credit

(including

employment incentive credit,

retail enterprise credit, and

historic barn rehabilitation

credit)

QETC employment credit

QETC facilities, operations,

and training credit

QEZE credit for real

property taxes

Security officer training

credit

Special additional mortgage

recording tax credit

1 Column totals

2 Temporary deferral refundable payout credit accumulated

(enter the amount from line 1,

2.

.............................................................................................................

column E; see instructions)

5021110094

1

1 2

2