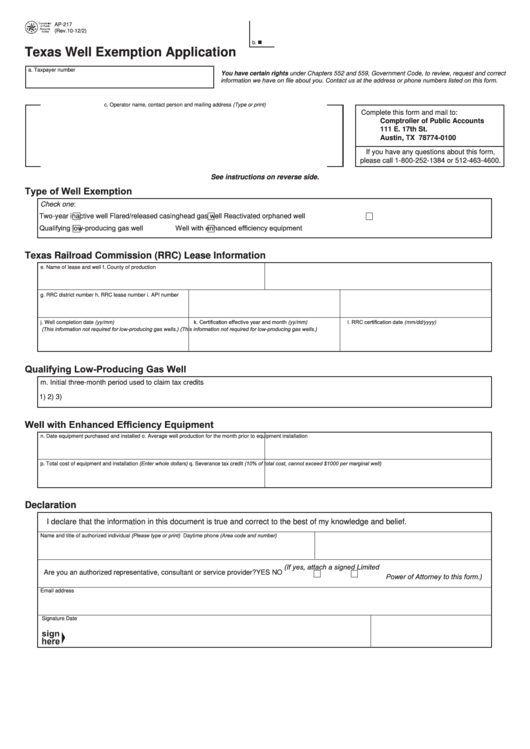

AP-217

PRINT FORM

CLEAR FORM

(Rev.10-12/2)

b.

Texas Well Exemption Application

a. Taxpayer number

You have certain rights under Chapters 552 and 559, Government Code, to review, request and correct

information we have on file about you. Contact us at the address or phone numbers listed on this form.

c. Operator name, contact person and mailing address (Type or print)

Complete this form and mail to:

Comptroller of Public Accounts

111 E. 17th St.

Austin, TX 78774-0100

If you have any questions about this form,

please call 1-800-252-1384 or 512-463-4600.

See instructions on reverse side.

Type of Well Exemption

Check one:

Two-year inactive well

Flared/released casinghead gas well

Reactivated orphaned well

Qualifying low-producing gas well

Well with enhanced efficiency equipment

Texas Railroad Commission (RRC) Lease Information

e. Name of lease and well

f. County of production

g. RRC district number

h. RRC lease number

i. API number

k. Certification effective year and month (yy/mm)

l. RRC certification date (mm/dd/yyyy)

j. Well completion date (yy/mm)

(This information not required for low-producing gas wells.)

(This information not required for low-producing gas wells.)

Qualifying Low-Producing Gas Well

m. Initial three-month period used to claim tax credits

1)

2)

3)

Well with Enhanced Efficiency Equipment

n. Date equipment purchased and installed

o. Average well production for the month prior to equipment installation

p. Total cost of equipment and installation (Enter whole dollars)

q. Severance tax credit (10% of total cost, cannot exceed $1000 per marginal well)

Declaration

I declare that the information in this document is true and correct to the best of my knowledge and belief.

Name and title of authorized individual (Please type or print)

Daytime phone (Area code and number)

(If yes, attach a signed Limited

......................

Are you an authorized representative, consultant or service provider?

YES

NO

Power of Attorney to this form.)

Email address

Signature

Date

1

1 2

2