Form 1120b-Me - Maine Franchise Tax Return For Financial Institutions - 2011

ADVERTISEMENT

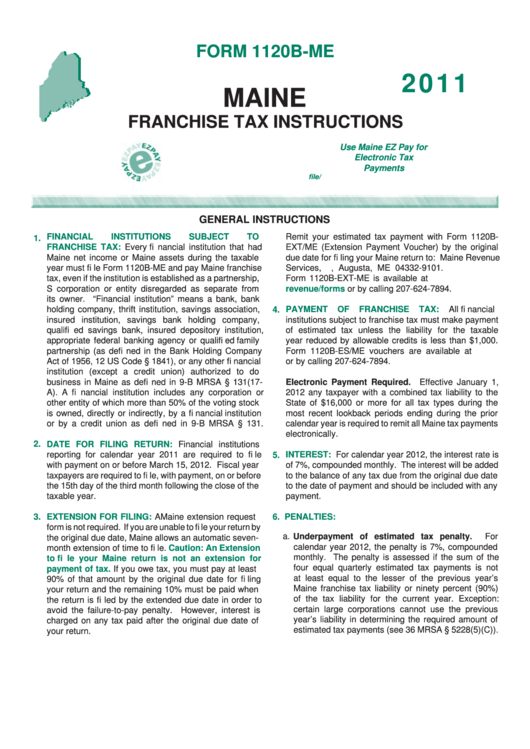

FORM 1120B-ME

2011

MAINE

FRANCHISE TAX INSTRUCTIONS

Use Maine EZ Pay for

Electronic Tax

Payments

le/gateway2.htm

GENERAL INSTRUCTIONS

FINANCIAL

INSTITUTIONS

SUBJECT

TO

Remit your estimated tax payment with Form 1120B-

1.

FRANCHISE TAX:

Every fi nancial institution that had

EXT/ME (Extension Payment Voucher) by the original

Maine net income or Maine assets during the taxable

due date for fi ling your Maine return to: Maine Revenue

year must fi le Form 1120B-ME and pay Maine franchise

Services, P.O. Box 9101, Augusta, ME 04332-9101.

tax, even if the institution is established as a partnership,

Form 1120B-EXT-ME is available at

S corporation or entity disregarded as separate from

revenue/forms

or by calling 207-624-7894.

its owner. “Financial institution” means a bank, bank

holding company, thrift institution, savings association,

PAYMENT

OF

FRANCHISE

TAX:

All

fi nancial

4.

insured institution, savings bank holding company,

institutions subject to franchise tax must make payment

qualifi ed savings bank, insured depository institution,

of estimated tax unless the liability for the taxable

appropriate federal banking agency or qualifi ed family

year reduced by allowable credits is less than $1,000.

partnership (as defi ned in the Bank Holding Company

Form 1120B-ES/ME vouchers are available at

www.

Act of 1956, 12 US Code § 1841), or any other fi nancial

maine.gov/revenue/forms

or by calling 207-624-7894.

institution (except a credit union) authorized to do

business in Maine as defi ned in 9-B MRSA § 131(17-

Electronic Payment Required. Effective January 1,

Effective January 1,

A). A fi nancial institution includes any corporation or

2012 any taxpayer with a combined tax liability to the

2012 any taxpayer with a combined tax liability to the

other entity of which more than 50% of the voting stock

State of $16,000 or more for all tax types during the

State of $16,000 or more for all tax types during the

is owned, directly or indirectly, by a fi nancial institution

most recent lookback periods ending during the prior

most recent lookback periods ending during the prior

or by a credit union as defi ned in 9-B MRSA § 131.

calendar year is required to remit all Maine tax payments

calendar year is required to remit all Maine tax payments

electronically.

electronically.

2.

DATE FOR FILING RETURN:

Financial institutions

reporting for calendar year 2011 are required to fi le

INTEREST:

For calendar year 2012, the interest rate is

5.

with payment on or before March 15, 2012. Fiscal year

of 7%, compounded monthly. The interest will be added

taxpayers are required to fi le, with payment, on or before

to the balance of any tax due from the original due date

the 15th day of the third month following the close of the

to the date of payment and should be included with any

taxable year.

payment.

3.

EXTENSION FOR FILING:

A Maine extension request

6. PENALTIES:

form is not required. If you are unable to fi le your return by

a.

Underpayment of estimated tax penalty.

For

the original due date, Maine allows an automatic seven-

calendar year 2012, the penalty is 7%, compounded

month extension of time to fi le.

Caution: An Extension

monthly. The penalty is assessed if the sum of the

to fi le your Maine return is not an extension for

four equal quarterly estimated tax payments is not

payment of tax.

If you owe tax, you must pay at least

at least equal to the lesser of the previous year’s

90% of that amount by the original due date for fi ling

Maine franchise tax liability or ninety percent (90%)

your return and the remaining 10% must be paid when

of the tax liability for the current year. Exception:

the return is fi led by the extended due date in order to

certain large corporations cannot use the previous

avoid the failure-to-pay penalty. However, interest is

year’s liability in determining the required amount of

charged on any tax paid after the original due date of

estimated tax payments (see 36 MRSA § 5228(5)(C)).

your return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9