Instructions For Form Nj-1040x - Amended Income Tax Resident Return - 2012

ADVERTISEMENT

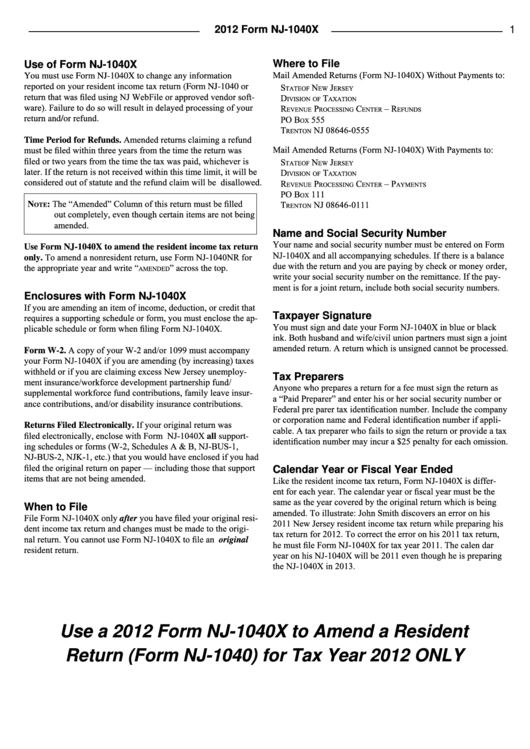

2012 Form NJ-1040X

1

Where to File

Use of Form NJ‑1040X

Mail Amended Returns (Form NJ‑1040X) Without Payments to:

You must use Form NJ‑1040X to change any information

S

n

J

reported on your resident income tax return (Form NJ‑1040 or

tate of

ew

erSey

return that was filed using NJ WebFile or approved vendor soft‑

d

t

iviSion of

axation

ware). Failure to do so will result in delayed processing of your

r

P

c

– r

evenue

roceSSing

enter

efundS

Po B

555

return and/or refund.

ox

t

nJ 08646-0555

renton

Time Period for Refunds. Amended returns claiming a refund

Mail Amended Returns (Form NJ‑1040X) With Payments to:

must be filed within three years from the time the return was

filed or two years from the time the tax was paid, whichever is

S

n

J

tate of

ew

erSey

later. If the return is not received within this time limit, it will be

d

t

iviSion of

axation

considered out of statute and the refund claim will be disallowed.

r

P

c

– P

evenue

roceSSing

enter

aymentS

Po B

111

ox

N

: The “Amended” Column of this return must be filled

t

nJ 08646-0111

ote

renton

out completely, even though certain items are not being

amended.

Name and Social Security Number

Your name and social security number must be entered on Form

Use Form NJ‑1040X to amend the resident income tax return

NJ‑1040X and all accompanying schedules. If there is a balance

only. To amend a nonresident return, use Form NJ‑1040NR for

due with the return and you are paying by check or money order,

” across the top.

amended

the appropriate year and write “

write your social security number on the remittance. If the pay‑

ment is for a joint return, include both social security numbers.

Enclosures with Form NJ‑1040X

If you are amending an item of income, deduction, or credit that

Taxpayer Signature

requires a supporting schedule or form, you must enclose the ap‑

You must sign and date your Form NJ‑1040X in blue or black

plicable schedule or form when filing Form NJ‑1040X.

ink. Both husband and wife/civil union partners must sign a joint

amended return. A return which is unsigned cannot be processed.

Form W‑2. A copy of your W‑2 and/or 1099 must accompany

your Form NJ‑1040X if you are amending (by increasing) taxes

withheld or if you are claiming excess New Jersey unemploy‑

Tax Preparers

ment insurance/workforce development partnership fund/

Anyone who prepares a return for a fee must sign the return as

supplemental workforce fund contributions, family leave insur‑

a “Paid Preparer” and enter his or her social security number or

ance contributions, and/or disability insurance contributions.

Federal pre parer tax identification number. Include the company

or corporation name and Federal identification number if appli‑

Returns Filed Electronically. If your original return was

cable. A tax preparer who fails to sign the return or provide a tax

filed electronically, enclose with Form NJ‑1040X all support‑

identification number may incur a $25 penalty for each omission.

ing schedules or forms (W‑2, Schedules A & B, NJ‑BUS‑1,

NJ‑BUS‑2, NJK‑1, etc.) that you would have enclosed if you had

filed the original return on paper — including those that support

Calendar Year or Fiscal Year Ended

items that are not being amended.

Like the resident income tax return, Form NJ‑1040X is differ‑

ent for each year. The calendar year or fiscal year must be the

same as the year covered by the original return which is being

When to File

amended. To illustrate: John Smith discovers an error on his

File Form NJ‑1040X only after you have filed your original resi‑

2011 New Jersey resident income tax return while preparing his

dent income tax return and changes must be made to the origi‑

tax return for 2012. To correct the error on his 2011 tax return,

nal return. You cannot use Form NJ‑1040X to file an original

he must file Form NJ‑1040X for tax year 2011. The calen dar

resident return.

year on his NJ‑1040X will be 2011 even though he is preparing

the NJ‑1040X in 2013.

Use a 2012 Form NJ-1040X to Amend a Resident

Return (Form NJ-1040) for Tax Year 2012 ONLY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4