Form Rew-2 - Residency Affidavit, Individual Transferor, Maine Exception 3(A)

ADVERTISEMENT

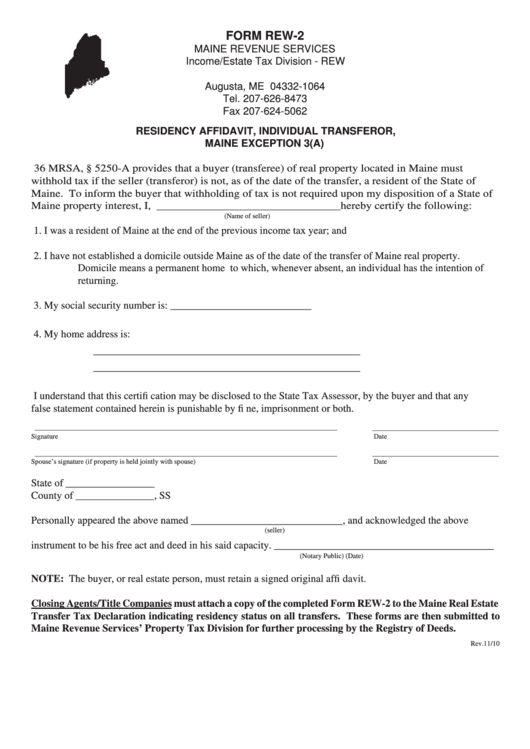

FORM REW-2

MAINE REVENUE SERVICES

Income/Estate Tax Division - REW

P.O. Box 1064

Augusta, ME 04332-1064

Tel. 207-626-8473

Fax 207-624-5062

RESIDENCY AFFIDAVIT, INDIVIDUAL TRANSFEROR,

MAINE EXCEPTION 3(A)

36 MRSA, § 5250-A provides that a buyer (transferee) of real property located in Maine must

withhold tax if the seller (transferor) is not, as of the date of the transfer, a resident of the State of

Maine. To inform the buyer that withholding of tax is not required upon my disposition of a State of

Maine property interest, I, ________________________________ hereby certify the following:

(Name of seller)

1. I was a resident of Maine at the end of the previous income tax year; and

2. I have not established a domicile outside Maine as of the date of the transfer of Maine real property.

Domicile means a permanent home to which, whenever absent, an individual has the intention of

returning.

3. My social security number is: ___________________________

4. My home address is:

___________________________________________________

___________________________________________________

I understand that this certifi cation may be disclosed to the State Tax Assessor, by the buyer and that any

false statement contained herein is punishable by fi ne, imprisonment or both.

Signature

Date

Spouse’s signature (if property is held jointly with spouse)

Date

State of _________________

County of _______________, SS

Personally appeared the above named _____________________________, and acknowledged the above

(seller)

instrument to be his free act and deed in his said capacity. __________________________________________

(Notary Public)

(Date)

NOTE: The buyer, or real estate person, must retain a signed original affi davit.

Closing Agents/Title Companies must attach a copy of the completed Form REW-2 to the Maine Real Estate

Transfer Tax Declaration indicating residency status on all transfers. These forms are then submitted to

Maine Revenue Services’ Property Tax Division for further processing by the Registry of Deeds.

Rev.11/10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1