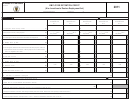

Schedule Eoac - Economic Opportunity Area Credit - 2011 Page 3

ADVERTISEMENT

Schedule EOAC Instructions

General Information

Line 3. The location of the certified project should be entered here.

What Is the Economic Opportunity Area Credit?

Line 4. Enter the date the project was certified by the EACC.

The Economic Opportunity Area Credit (EOAC) is a tax credit equal to

If you are an S corporation shareholder, you will be notified by the S

5% of the cost of property purchased for business use within a Certi-

corporation of the amount to enter in line 9. If you are a general or

fied Project in an EOA. The credit covers all property that is 1) eligible

limited partner you will be notified by the partnership of the amount

for the current 3% Investment Tax Credit (ITC) and 2) used exclu-

to enter in line 9.

sively in a certified project in an EOA. The 5% EOAC and the 3% ITC

cannot be taken for the same property. In the case of a taxpayer

Line 5. Enter here an accurate description of the qualifying property

having property which meets the criteria for both credits, the taxpayer

for the 5% EOAC. The credit is limited to property purchased for busi-

may choose either of the credits, but may not take both credits for the

ness use within the EOA.

same property.

Line 6. Enter the total cost of the property purchased for business

What Is an EOA?

use in the certified project as approved by the EACC.

An economic opportunity area is an area that has been designated

Line 7. Enter the amount taken for any U.S. basis reduction.

by the Economic Assistance Coordinating Council (EACC) to be a

Line 8. Subtract line 7 from line 6. This is the total cost of the prop-

“decadent area” or a “blighted open area” which is detrimental to the

erty after deducting any U.S. basis reduction.

sound growth of a community and unlikely to be developed by the

ordinary operation of private enterprise.

Line 9. Multiply line 8 by 5% (.05). This equals the available current

year EOAC.

Who Is Eligible to Take the EOA Credit?

The credit is available to all businesses regardless of whether the

Credit allowable in the current year. Most taxpayers can offset up

business is a sole proprietorship, partnership, corporate trust or cor-

to 50% of their tax due with the EOAC.

poration. It is also available to financial institutions, insurance com-

Line 10. Enter in line 10 your total tax from Form 1, line 28; Form

panies and public service corporations.

1-NR/PY, line 32; or Form 2, line 41; Form 355, line 6; Form 355S,

What If My Economic Opportunity Area Credit

line 9; Form 355U, Schedule U-ST, line 37. All other taxpayers sub-

ject to MGL Ch. 63 must enter the amount from the appropriate line

Originated from a Pass-Through Entity?

on their return.

If this credit originated from a pass-through entity, for example, a part-

nership, you must enter the name and identification number of that

Line 11. Taxpayers filing Form 1, Form 1-NR/PY or Form 2, add the

pass-through entity and begin completing this schedule at line 10.

Limited Income Credit, Credit for Income Taxes Paid to Other Juris-

dictions, Lead Paint Credit, Economic Development Incentive Pro-

What Is a Certified Project?

gram Credit, Septic Credit, Low-Income Housing Credit, Historic Re-

A Certified Project is a business proposal that has been approved by

habilitation Credit, Film Incentive Credit, Medical Device Credit and

the EACC. To qualify as a valid business proposal, the proposal

Brownfields Credit, if any. Enter the result in line 11. All other tax-

must include a workable plan to increase employment in the EOA

payers enter “0.”

and must be approved by the municipality located in the EOA.

Line 12. Subtract line 11 from line 10 and enter the result here. Do

What Type of Property Is Eligible for the Credit?

not enter less than “0.”

Property purchased for business use in a certified project may be

Line 13. Enter 50% of line 12 in line 13.

used in the calculation of the credit. This property must qualify for the

credit allowed under Massachusetts General Laws (MGL) Ch. 63,

Line 14. Add line 9 and any prior years unused EOAC from 2010,

sec. 31A.

Schedule EOAC, line 17, column c. Enter the result in line 14.

Are There Limitations to the Credit?

Line 15. For taxpayers filing Form 1, Form 1-NR/PY or Form 2, if line

Yes. Taxpayers subject to tax under MGL Ch. 62 (sole proprietor-

13 is greater than or equal to line 14, enter line 14 here. If line 13 is

ships, trusts and partnerships) are allowed to use the EOAC to off-

less than line 14, enter line 13 here. Corporations filing Form 355U

set up to 50% of their tax due. Corporations may offset up to 50% of

and eligible to share the credit with other members of the combined

the excise due with the EOAC. Corporations cannot use the credit to

group may exceed the amount on line 13 if the additional credits will

lower their excise below the minimum. The 50% limitation does

be shared. See Form 355U instructions.

apply to financial institutions, insurance companies and public serv-

Enter the amount from line 15 on Form 1, Schedule Z; Form 1-NR/PY,

ice corporations.

Schedule Z; Form 2, line 44. Taxpayers filing Form 355U, enter the

May Excess Credits Be Carried Over from

amount from line 15 on Schedule U-IC, line 4. All other taxpayers sub-

ject to MGL Ch. 63 enter the amount from line 15 on the appropriate

Year to Year?

schedule or line item of their return.

Yes. Taxpayers subject to tax under MGL Ch. 62 may carryover un-

used credits for ten years. Taxpayers subject to tax under MGL Ch. 63

Line 16. Taxpayers with more credits available (line 14) than credits

may carry over for ten years any credits not used due to the minimum

used (line 15) may be eligible to carry over the unused credits for up

excise limitation. However, any credits not used due to the 50% limi-

to 10 years. Corporations unable to use credits because of the 50%

tation can be carried over for an unlimited period of time.

limitation may carry such credits over for an unlimited number of

years. Taxpayers with credits eligible for carryover to 2012 complete

Line Instructions

lines 16 and 17.

Line 1. Check the type of business for which the property is being

Any credits not used in the current year due to the 50% limitation may

used.

be carried over for an unlimited number of years.

Line 2. Enter the type of return that you file. Enclose a copy of this

schedule with your return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3