Schedule K-83 - Electric Cogeneration Facility Credit

ADVERTISEMENT

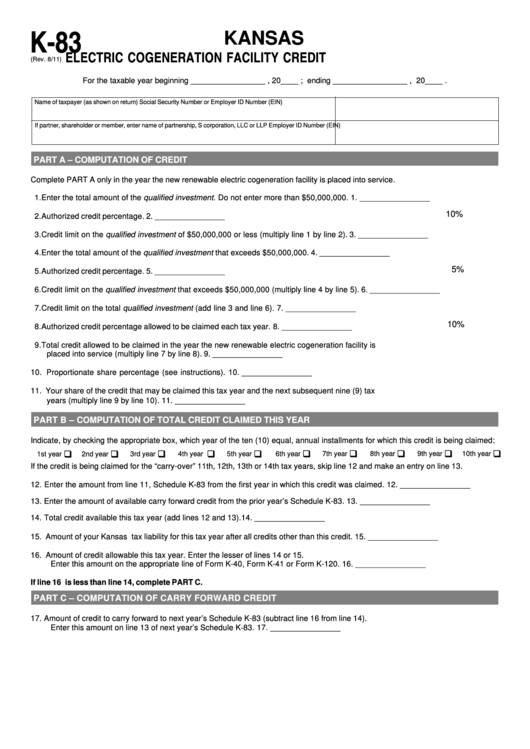

K-83

KANSAS

ELECTRIC COGENERATION FACILITY CREDIT

(Rev. 8/11)

For the taxable year beginning _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

PART A – COMPUTATION OF CREDIT

Complete PART A only in the year the new renewable electric cogeneration facility is placed into service.

1. Enter the total amount of the qualified investment. Do not enter more than $50,000,000.

1. ________________

10%

2. Authorized credit percentage.

2. ________________

3. Credit limit on the qualified investment of $50,000,000 or less (multiply line 1 by line 2).

3. ________________

4. Enter the total amount of the qualified investment that exceeds $50,000,000.

4. ________________

5%

5. Authorized credit percentage.

5. ________________

6. Credit limit on the qualified investment that exceeds $50,000,000 (multiply line 4 by line 5).

6. ________________

7. Credit limit on the total qualified investment (add line 3 and line 6).

7. ________________

10%

8. Authorized credit percentage allowed to be claimed each tax year.

8. ________________

9. Total credit allowed to be claimed in the year the new renewable electric cogeneration facility is

placed into service (multiply line 7 by line 8).

9. ________________

10. Proportionate share percentage (see instructions).

10. ________________

11. Your share of the credit that may be claimed this tax year and the next subsequent nine (9) tax

years (multiply line 9 by line 10).

11. ________________

PART B – COMPUTATION OF TOTAL CREDIT CLAIMED THIS YEAR

Indicate, by checking the appropriate box, which year of the ten (10) equal, annual installments for which this credit is being claimed:

‰

‰

‰

‰

‰

‰

‰

‰

‰

‰

1st year

2nd year

3rd year

4th year

5th year

6th year

7th year

8th year

9th year

10th year

If the credit is being claimed for the “carry-over” 11th, 12th, 13th or 14th tax years, skip line 12 and make an entry on line 13.

12.

Enter the amount from line 11, Schedule K-83 from the first year in which this credit was claimed.

12. ________________

13.

Enter the amount of available carry forward credit from the prior year’s Schedule K-83.

13. ________________

14.

Total credit available this tax year (add lines 12 and 13).

14. ________________

15. Amount of your Kansas tax liability for this tax year after all credits other than this credit.

15. ________________

16. Amount of credit allowable this tax year. Enter the lesser of lines 14 or 15.

Enter this amount on the appropriate line of Form K-40, Form K-41 or Form K-120.

16. ________________

If line 16 is less than line 14, complete PART C.

PART C – COMPUTATION OF CARRY FORWARD CREDIT

17.

Amount of credit to carry forward to next year’s Schedule K-83 (subtract line 16 from line 14).

Enter this amount on line 13 of next year’s Schedule K-83.

17. ________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2