CIFT-620 (1/12)

Department of Revenue • Page 27

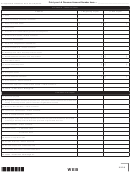

FEDERAL INCOME TAX DEDUCTION WORKSHEET

(See instructions on page 28.)

1A. Louisiana net income – From Form CIFT-620, Line 1A.... ................................................ $ _______________________________

1B. Loss carryforward – From Form CIFT-620, Line 1C.......................................................... $ _______________________________

1C. Loss carryback – From Form CIFT-620, Line 1D .............................................................. $ _______________________________

1D. Louisiana net income before federal income tax

deduction – Subtract Lines 1B and 1C from Line 1A. ....................................................... $ _______________________________

2. Adjustments to convert Louisiana net income to a federal basis

________________________________________________

$ _____________________________

________________________________________________

$ _____________________________

________________________________________________

$ _____________________________

________________________________________________

$ _____________________________

________________________________________________

$ _____________________________

________________________________________________

$ _____________________________

________________________________________________

$ _____________________________

________________________________________________

$ _____________________________

Net adjustment

$ _____________________________

3. Louisiana net income on a federal basis – Subtract Line 2 from Line 1D. ........................ $ _______________________________

4. Federal net income............................................................................................................ $ _______________________________

5. Less creditable expenses .................................................................................................. $ _______________________________

6. Federal net income – Subtract Line 5 from Line 4. ........................................................... $ _______________________________

___ ___ ___ . ___ ___ %

7. Ratio of Louisiana net income to federal net income – Divide Line 3 by Line 6. ..............

________________________________

8. Federal income tax liability ................................................................................................ $ _______________________________

9. Less alternative minimum tax ............................................................................................ $ _______________________________

10. Less environmental tax ..................................................................................................... $ _______________________________

11. Federal income tax – Subtract Lines 9 and 10 from Line 8. ............................................. $ _______________________________

12. Federal income tax attributable to Louisiana income – Multiply Line 11 by Line 7. ........... $ _______________________________

13. Federal income tax disaster relief credits .......................................................................... $ _______________________________

13a. Federal income tax disaster relief credit attributable to Louisiana –

Multiply Line 13 by Line 7 and print the amount here and on Form CIFT-620, Line 1E1. .... $ _______________________________

14. Add Lines 12 and 13a. – Print on Form CIFT-620, Line 1E. ............................................. $ _______________________________

The amount of federal income tax to be deducted is that portion levied on the income derived from sources in this state. See R.S. 47:287.83

and 85 and Louisiana Administrative Code 61:I.1122 and 1123 for specific information regarding the computation of the federal income tax

deduction.

WEB

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11