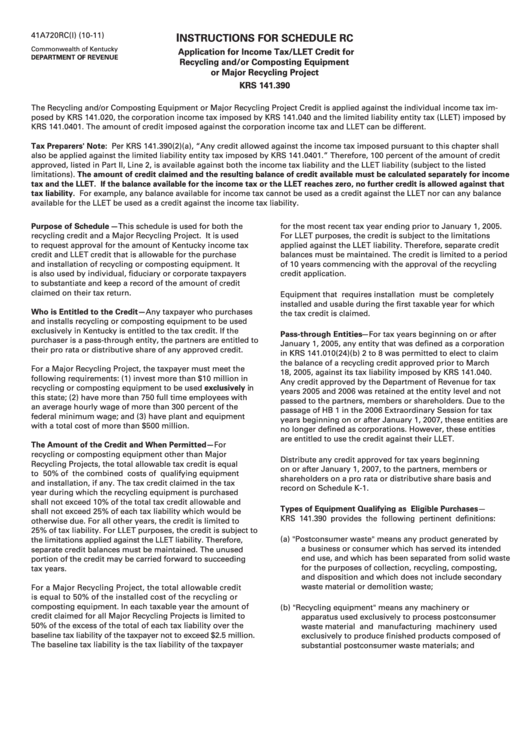

Instructions For Schedule Rc (Form 41a720rc(I)) - Application For Income Tax/llet Credit For Recycling And/or Composting Equipment Or Major Recycling Project

ADVERTISEMENT

41A720RC(I) (10-11)

I

NSTRUCTIONS FOR SCHEDULE RC

Commonwealth of Kentucky

Application for Income Tax/LLET Credit for

DEPARTMENT OF REVENUE

Recycling and/or Composting Equipment

or Major Recycling Project

KRS 141.390

The Recycling and/or Composting Equipment or Major Recycling Project Credit is applied against the individual income tax im-

posed by KRS 141.020, the corporation income tax imposed by KRS 141.040 and the limited liability entity tax (LLET) imposed by

KRS 141.0401. The amount of credit imposed against the corporation income tax and LLET can be different.

Tax Preparers' Note: Per KRS 141.390(2)(a), “Any credit allowed against the income tax imposed pursuant to this chapter shall

also be applied against the limited liability entity tax imposed by KRS 141.0401. ” Therefore, 100 percent of the amount of credit

approved, listed in Part II, Line 2, is available against both the income tax liability and the LLET liability (subject to the listed

limitations). The amount of credit claimed and the resulting balance of credit available must be calculated separately for income

tax and the LLET. If the balance available for the income tax or the LLET reaches zero, no further credit is allowed against that

tax liability. For example, any balance available for income tax cannot be used as a credit against the LLET nor can any balance

available for the LLET be used as a credit against the income tax liability.

Purpose of Schedule—This schedule is used for both the

for the most recent tax year ending prior to January 1, 2005.

recycling credit and a Major Recycling Project. It is used

For LLET purposes, the credit is subject to the limitations

to request approval for the amount of Kentucky income tax

applied against the LLET liability. Therefore, separate credit

credit and LLET credit that is allowable for the purchase

balances must be maintained. The credit is limited to a period

and installation of recycling or composting equipment. It

of 10 years commencing with the approval of the recycling

is also used by individual, fiduciary or corporate taxpayers

credit application.

to substantiate and keep a record of the amount of credit

claimed on their tax return.

Equipment that requires installation must be completely

installed and usable during the first taxable year for which

Who is Entitled to the Credit—Any taxpayer who purchases

the tax credit is claimed.

and installs recycling or composting equipment to be used

exclusively in Kentucky is entitled to the tax credit. If the

Pass-through Entities—For tax years beginning on or after

purchaser is a pass-through entity, the partners are entitled to

January 1, 2005, any entity that was defined as a corporation

their pro rata or distributive share of any approved credit.

in KRS 141.010(24)(b) 2 to 8 was permitted to elect to claim

the balance of a recycling credit approved prior to March

For a Major Recycling Project, the taxpayer must meet the

18, 2005, against its tax liability imposed by KRS 141.040.

following requirements: (1) invest more than $10 million in

Any credit approved by the Department of Revenue for tax

recycling or composting equipment to be used exclusively in

years 2005 and 2006 was retained at the entity level and not

this state; (2) have more than 750 full time employees with

passed to the partners, members or shareholders. Due to the

an average hourly wage of more than 300 percent of the

passage of HB 1 in the 2006 Extraordinary Session for tax

federal minimum wage; and (3) have plant and equipment

years beginning on or after January 1, 2007, these entities are

with a total cost of more than $500 million.

no longer defined as corporations. However, these entities

are entitled to use the credit against their LLET.

The Amount of the Credit and When Permitted—For

recycling or composting equipment other than Major

Distribute any credit approved for tax years beginning

Recycling Projects, the total allowable tax credit is equal

on or after January 1, 2007, to the partners, members or

to 50% of the combined costs of qualifying equipment

shareholders on a pro rata or distributive share basis and

and installation, if any. The tax credit claimed in the tax

record on Schedule K-1.

year during which the recycling equipment is purchased

shall not exceed 10% of the total tax credit allowable and

Types of Equipment Qualifying as Eligible Purchases—

shall not exceed 25% of each tax liability which would be

KRS 141.390 provides the following pertinent definitions:

otherwise due. For all other years, the credit is limited to

25% of tax liability. For LLET purposes, the credit is subject to

(a)

"Postconsumer waste" means any product generated by

the limitations applied against the LLET liability. Therefore,

a business or consumer which has served its intended

separate credit balances must be maintained. The unused

end use, and which has been separated from solid waste

portion of the credit may be carried forward to succeeding

for the purposes of collection, recycling, composting,

tax years.

and disposition and which does not include secondary

waste material or demolition waste;

For a Major Recycling Project, the total allowable credit

is equal to 50% of the installed cost of the recycling or

composting equipment. In each taxable year the amount of

(b)

"Recycling equipment" means any machinery or

credit claimed for all Major Recycling Projects is limited to

apparatus used exclusively to process postconsumer

50% of the excess of the total of each tax liability over the

waste material and manufacturing machinery used

baseline tax liability of the taxpayer not to exceed $2.5 million.

exclusively to produce finished products composed of

The baseline tax liability is the tax liability of the taxpayer

substantial postconsumer waste materials; and

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3