Schedule K-76 - Single City Port Authority Credit

ADVERTISEMENT

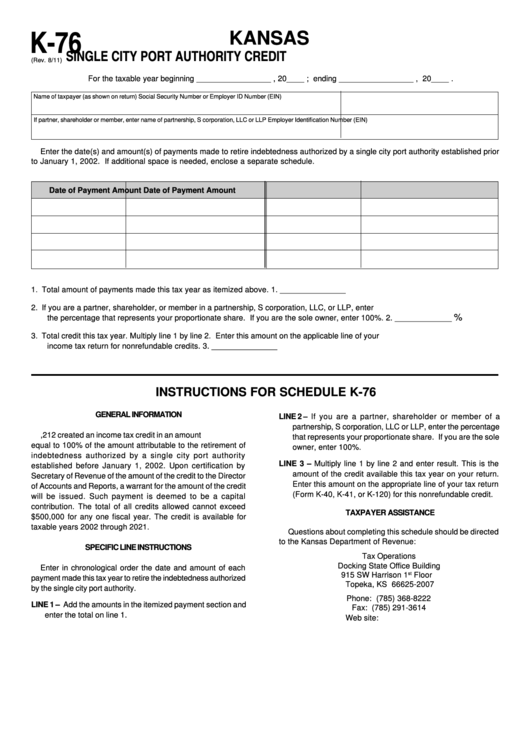

K-76

KANSAS

SINGLE CITY PORT AUTHORITY CREDIT

(Rev. 8/11)

For the taxable year beginning _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer Identification Number (EIN)

Enter the date(s) and amount(s) of payments made to retire indebtedness authorized by a single city port authority established prior

to January 1, 2002. If additional space is needed, enclose a separate schedule.

Date of Payment

Amount

Date of Payment

Amount

1. Total amount of payments made this tax year as itemized above.

1. _______________

2. If you are a partner, shareholder, or member in a partnership, S corporation, LLC, or LLP, enter

%

the percentage that represents your proportionate share. If you are the sole owner, enter 100%.

2. _____________

3. Total credit this tax year. Multiply line 1 by line 2. Enter this amount on the applicable line of your

income tax return for nonrefundable credits.

3. _______________

INSTRUCTIONS FOR SCHEDULE K-76

GENERAL INFORMATION

LINE 2 – If you are a partner, shareholder or member of a

partnership, S corporation, LLC or LLP, enter the percentage

K.S.A. 79-32,212 created an income tax credit in an amount

that represents your proportionate share. If you are the sole

equal to 100% of the amount attributable to the retirement of

owner, enter 100%.

indebtedness authorized by a single city port authority

LINE 3 – Multiply line 1 by line 2 and enter result. This is the

established before January 1, 2002. Upon certification by

amount of the credit available this tax year on your return.

Secretary of Revenue of the amount of the credit to the Director

Enter this amount on the appropriate line of your tax return

of Accounts and Reports, a warrant for the amount of the credit

(Form K-40, K-41, or K-120) for this nonrefundable credit.

will be issued. Such payment is deemed to be a capital

contribution. The total of all credits allowed cannot exceed

TAXPAYER ASSISTANCE

$500,000 for any one fiscal year. The credit is available for

taxable years 2002 through 2021.

Questions about completing this schedule should be directed

to the Kansas Department of Revenue:

SPECIFIC LINE INSTRUCTIONS

Tax Operations

Docking State Office Building

Enter in chronological order the date and amount of each

st

915 SW Harrison 1

Floor

payment made this tax year to retire the indebtedness authorized

Topeka, KS 66625-2007

by the single city port authority.

Phone: (785) 368-8222

LINE 1 – Add the amounts in the itemized payment section and

Fax: (785) 291-3614

enter the total on line 1.

Web site:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1