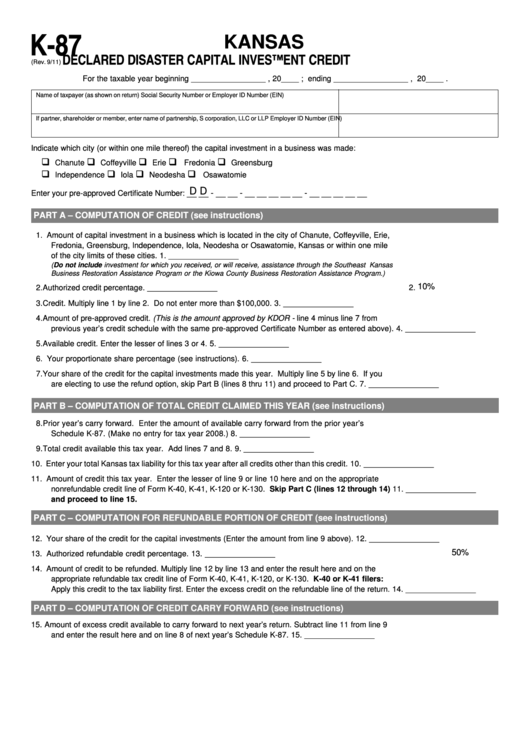

Schedule K-87 - Declared Disaster Capital Investment Credit

ADVERTISEMENT

K-87

KANSAS

DECLARED DISASTER CAPITAL INVESTMENT CREDIT

(Rev. 9/11)

For the taxable year beginning _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

Indicate which city (or within one mile thereof) the capital investment in a business was made:

‰

‰

‰

‰

‰

Chanute

Coffeyville

Erie

Fredonia

Greensburg

‰

‰

‰

‰

Independence

Iola

Neodesha

Osawatomie

D D

__ __ - __ __ - __ __ __ __ __ - __ __ __ __ __

Enter your pre-approved Certificate Number:

PART A – COMPUTATION OF CREDIT (see instructions)

1. Amount of capital investment in a business which is located in the city of Chanute, Coffeyville, Erie,

Fredonia, Greensburg, Independence, Iola, Neodesha or Osawatomie, Kansas or within one mile

of the city limits of these cities.

1.

________________

(Do not include investment for which you received, or will receive, assistance through the Southeast Kansas

Business Restoration Assistance Program or the Kiowa County Business Restoration Assistance Program.)

10%

2. Authorized credit percentage.

2.

________________

3. Credit. Multiply line 1 by line 2. Do not enter more than $100,000.

3.

________________

4. Amount of pre-approved credit. (This is the amount approved by KDOR - line 4 minus line 7 from

previous year’s credit schedule with the same pre-approved Certificate Number as entered above).

4.

________________

5. Available credit. Enter the lesser of lines 3 or 4.

5.

________________

6. Your proportionate share percentage (see instructions).

6.

________________

7. Your share of the credit for the capital investments made this year. Multiply line 5 by line 6. If you

are electing to use the refund option, skip Part B (lines 8 thru 11) and proceed to Part C.

7.

________________

PART B – COMPUTATION OF TOTAL CREDIT CLAIMED THIS YEAR (see instructions)

8. Prior year’s carry forward. Enter the amount of available carry forward from the prior year’s

Schedule K-87. (Make no entry for tax year 2008.)

8.

________________

9. Total credit available this tax year. Add lines 7 and 8.

9.

________________

10. Enter your total Kansas tax liability for this tax year after all credits other than this credit.

10.

________________

11. Amount of credit this tax year. Enter the lesser of line 9 or line 10 here and on the appropriate

nonrefundable credit line of Form K-40, K-41, K-120 or K-130. Skip Part C (lines 12 through 14)

11.

________________

and proceed to line 15.

PART C – COMPUTATION FOR REFUNDABLE PORTION OF CREDIT (see instructions)

12. Your share of the credit for the capital investments (Enter the amount from line 9 above).

12.

________________

50%

13. Authorized refundable credit percentage.

13.

________________

14. Amount of credit to be refunded. Multiply line 12 by line 13 and enter the result here and on the

appropriate refundable tax credit line of Form K-40, K-41, K-120, or K-130. K-40 or K-41 filers:

Apply this credit to the tax liability first. Enter the excess credit on the refundable line of the return.

14.

________________

PART D – COMPUTATION OF CREDIT CARRY FORWARD (see instructions)

15.

Amount of excess credit available to carry forward to next year’s return. Subtract line 11 from line 9

and enter the result here and on line 8 of next year’s Schedule K-87.

15.

________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2