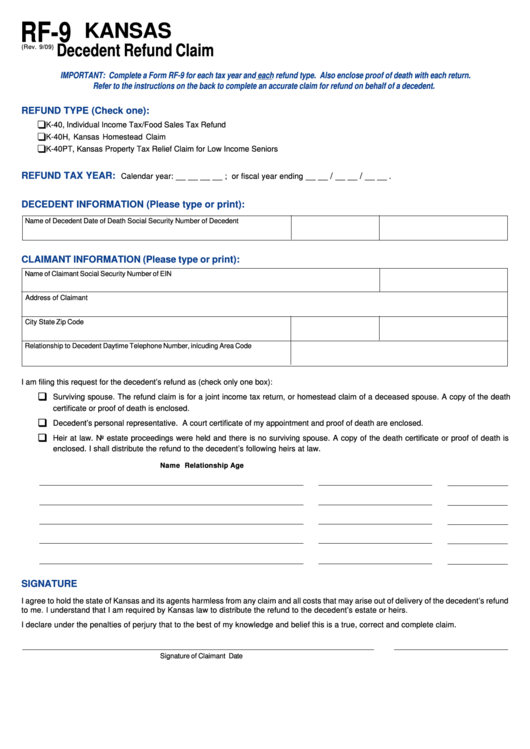

Form Rf-9 - Decedent Refund Claim

ADVERTISEMENT

RF-9

KANSAS

Decedent Refund Claim

(Rev. 9/09)

IMPORTANT: Complete a Form RF-9 for each tax year and each refund type. Also enclose proof of death with each return.

Refer to the instructions on the back to complete an accurate claim for refund on behalf of a decedent.

REFUND TYPE (Check one):

❑

K-40, Individual Income Tax/Food Sales Tax Refund

❑

K-40H, Kansas Homestead Claim

❑

K-40PT, Kansas Property Tax Relief Claim for Low Income Seniors

REFUND TAX YEAR:

__ __ __ __

__ __ / __ __ / __ __

Calendar year:

; or fiscal year ending

.

DECEDENT INFORMATION (Please type or print):

Name of Decedent

Date of Death

Social Security Number of Decedent

CLAIMANT INFORMATION (Please type or print):

Name of Claimant

Social Security Number of EIN

Address of Claimant

City

State

Zip Code

Relationship to Decedent

Daytime Telephone Number, inlcuding Area Code

I am filing this request for the decedent’s refund as (check only one box):

‰

Surviving spouse. The refund claim is for a joint income tax return, or homestead claim of a deceased spouse. A copy of the death

certificate or proof of death is enclosed.

‰

Decedent’s personal representative. A court certificate of my appointment and proof of death are enclosed.

‰

Heir at law. No estate proceedings were held and there is no surviving spouse. A copy of the death certificate or proof of death is

enclosed. I shall distribute the refund to the decedent’s following heirs at law.

Name

Relationship

Age

SIGNATURE

I agree to hold the state of Kansas and its agents harmless from any claim and all costs that may arise out of delivery of the decedent’s refund

to me. I understand that I am required by Kansas law to distribute the refund to the decedent’s estate or heirs.

I declare under the penalties of perjury that to the best of my knowledge and belief this is a true, correct and complete claim.

Signature of Claimant

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2