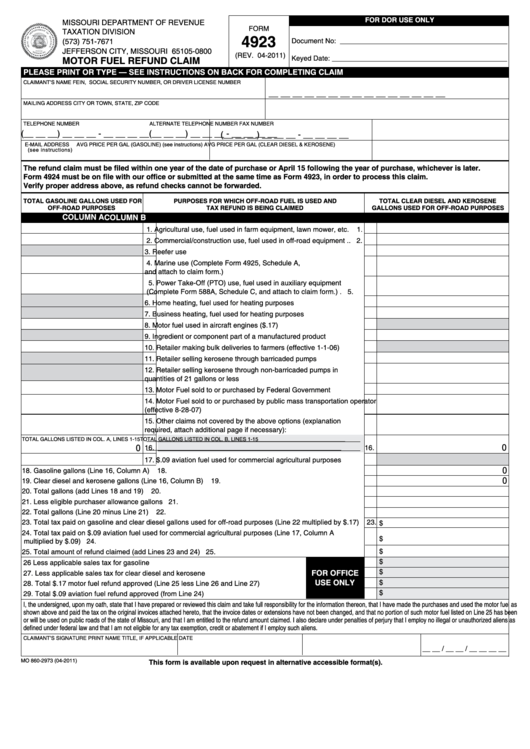

FOR DOR USE ONLY

MISSOURI DEPARTMENT OF REVENUE

FORM

TAXATION DIVISION

Reset Form

Print Form

4923

P.O. BOX 800

(573) 751-7671

Document No: ___________________________________________

JEFFERSON CITY, MISSOURI 65105-0800

(REV. 04-2011)

Keyed Date: _____________________________________________

MOTOR FUEL REFUND CLAIM

PLEASE PRINT OR TYPE — SEE INSTRUCTIONS ON BACK FOR COMPLETING CLAIM

CLAIMANT’S NAME

FEIN, SOCIAL SECURITY NUMBER, OR DRIVER LICENSE NUMBER

__ __ __ __ __ __ __ __ __ __ __ __ __ __ __

MAILING ADDRESS

CITY OR TOWN, STATE, ZIP CODE

TELEPHONE NUMBER

ALTERNATE TELEPHONE NUMBER

FAX NUMBER

(__ __ __) __ __ __ - __ __ __ __

(__ __ __) __ __ __ - __ __ __ __

(__ __ __) __ __ __ - __ __ __ __

E-MAIL ADDRESS

AVG PRICE PER GAL (GASOLINE) (see instructions)

AVG PRICE PER GAL (CLEAR DIESEL & KEROSENE)

(see instructions)

The refund claim must be filed within one year of the date of purchase or April 15 following the year of purchase, whichever is later.

Form 4924 must be on file with our office or submitted at the same time as Form 4923, in order to process this claim.

Verify proper address above, as refund checks cannot be forwarded.

TOTAL GASOLINE GALLONS USED FOR

PURPOSES FOR WHICH OFF-ROAD FUEL IS USED AND

TOTAL CLEAR DIESEL AND KEROSENE

OFF-ROAD PURPOSES

TAX REFUND IS BEING CLAIMED

GALLONS USED FOR OFF-ROAD PURPOSES

ROUND ALL GALLONS TO NEAREST GALLON

COLUMN A

COLUMN B

1. Agricultural use, fuel used in farm equipment, lawn mower, etc.

1.

2. Commercial/construction use, fuel used in off-road equipment ..

2.

3. Reefer use ..................................................................................

3.

4. Marine use (Complete Form 4925, Schedule A,

and attach to claim form.) ...........................................................

4.

5. Power Take-Off (PTO) use, fuel used in auxiliary equipment

(Complete Form 588A, Schedule C, and attach to claim form.) .

5.

6. Home heating, fuel used for heating purposes ...........................

6.

7. Business heating, fuel used for heating purposes ......................

7.

8. Motor fuel used in aircraft engines ($.17) ...................................

8.

9. Ingredient or component part of a manufactured product ..........

9.

10. Retailer making bulk deliveries to farmers (effective 1-1-06) ......

10.

11. Retailer selling kerosene through barricaded pumps ..................

11.

12. Retailer selling kerosene through non-barricaded pumps in

quantities of 21 gallons or less ....................................................

12.

13. Motor Fuel sold to or purchased by Federal Government ..........

13.

14. Motor Fuel sold to or purchased by public mass transportation operator

(effective 8-28-07)..........................................................................

14.

15. Other claims not covered by the above options (explanation

required, attach additional page if necessary): ..............................

15.

___________________________________________________

TOTAL GALLONS LISTED IN COL. A, LINES 1-15

TOTAL GALLONS LISTED IN COL. B, LINES 1-15

0

0

__________________________________________________

16.

16.

17. $.09 aviation fuel used for commercial agricultural purposes ........

17.

0

18. Gasoline gallons (Line 16, Column A)

18.

0

19. Clear diesel and kerosene gallons (Line 16, Column B)

19.

20. Total gallons (add Lines 18 and 19)

20.

21. Less eligible purchaser allowance gallons

21.

22. Total gallons (Line 20 minus Line 21)

22.

23. Total tax paid on gasoline and clear diesel gallons used for off-road purposes (Line 22 multiplied by $.17)

23.

$

24. Total tax paid on $.09 aviation fuel used for commercial agricultural purposes (Line 17, Column A

$

multiplied by $.09)

24.

25. Total amount of refund claimed (add Lines 23 and 24)

25.

$

$

26

Less applicable sales tax for gasoline .............................................................................

26.

$

FOR OFFICE

27. Less applicable sales tax for clear diesel and kerosene .................................................

27.

USE ONLY

$

28. Total $.17 motor fuel refund approved (Line 25 less Line 26 and Line 27) ....................

28.

$

29. Total $.09 aviation fuel refund approved (from Line 24) .................................................

29.

I, the undersigned, upon my oath, state that I have prepared or reviewed this claim and take full responsibility for the information thereon, that I have made the purchases and used the motor fuel as

shown above and paid the tax on the original invoices attached hereto, that the invoice dates or extensions have not been changed, and that no portion of such motor fuel listed on Line 25 has been

or will be used on public roads of the state of Missouri, and that I am entitled to the refund amount claimed. I also declare under penalties of perjury that I employ no illegal or unauthorized aliens as

defined under federal law and that I am not eligible for any tax exemption, credit or abatement if I employ such aliens.

CLAIMANT’S SIGNATURE

PRINT NAME

TITLE, IF APPLICABLE

DATE

__ __ / __ __ / __ __ __ __

MO 860-2973 (04-2011)

This form is available upon request in alternative accessible format(s).

1

1 2

2