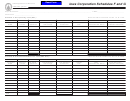

Instructions for Schedule F - Net Operating Loss (NOL)

Computation of a separate corporation’s contribution to

consolidated income or net operating loss subject to Iowa tax for

Schedule F should be attached for supporting detail if a net

purposes of net operating loss carryover and carryback limitations must

operating loss (NOL) deduction is taken on IA 1120, line 15 or IA

be as follows:

1120A, line 9. Be sure to reflect any prior Iowa audits which may have

A

C

D

E =

separate corporation contribution to

x

x

+

corrected amounts originally reported. The NOL amount applied to the

B

A

consolidated income subject to Iowa tax.

current year must not exceed the amount on the IA 1120, line 14 or IA

1120A, line 8.

A = Separate corporation gross sales within and without Iowa

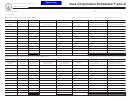

The net operating loss must be carried back or over to the

after elimination of all intercompany transactions.

applicable period as a reduction of the net income attributable to Iowa

B = Consolidated gross sales within and without Iowa after

for that period. An Iowa net operating loss cannot be carried back to a

elimination of all intercompany transactions.

period in which the taxpayer was not doing business in Iowa. A net

C = Iowa consolidated net income subject to apportionment

operating loss cannot be carried forward if it was incurred in a period in

(IA 1120, line 10).

which the taxpayer was not doing business in Iowa. If the election

D = Separate corporation gross sales within Iowa after

under section 172(b)(c) of the Internal Revenue Code is made, the Iowa

elimination of all intercompany transactions.

net operating loss must also be carried forward. The carryforward is 15

E = Separate corporation income allocable to Iowa.

taxable periods for tax periods beginning on or before August 5, 1997.

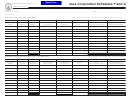

Instructions for Schedule G -

For tax periods beginning after August 5, 1997, but before January

Alternative Minimum Tax Loss (AMT NOL)

1, 2009, net operating losses may be carried back two taxable periods

and carried forward 20 taxable periods. Net operating losses for tax

Schedule G is required if there is an alternative minimum tax net

periods beginning after August 5, 1997, but before January 1, 2009, can

operating loss (AMT NOL) claimed on Schedule IA 4626. These losses

be carried back three years only for losses incurred in a presidentially-

are carried back or forward in the same way as regular net operating

declared disaster area by a taxpayer engaged in a small business.

losses.

Iowa did not adopt the 5-year carryback provision for net

The computation of a separate corporation’s contribution to

operating losses incurred in 2008 for small businesses as set forth in the

consolidated AMT income or AMT net operating loss for purposes of

federal American Recovery and Reinvestment Act of 2009.

the net operating loss carryover or carryback is the same formula as set

forth above, except that C is the Iowa consolidated AMT income

The carryback period for net operating losses from farming

subject to apportionnment from the Schedule IA 4626, line 7.

businesses is five years to the extent the net operating losses are for tax

years beginning on or after January 1, 1998, but before January 1, 2009.

The AMT NOL amount applied to the current year is limited to

Any Contribution Conversion Adjustment, if applicable, should be

90% of the amount on line 11 on Schedule IA 4626. The total for

listed separately for each period.

column E must equal the amount entered on the Schedule IA 4626, line

12.

For tax periods beginning on or after January 1, 2009, both the

Iowa net operating loss (NOL) and alternative minimum tax net

operating loss (AMT NOL) can only be carried forward 20 taxable

periods.

42-020b (06/24/09)

1

1 2

2