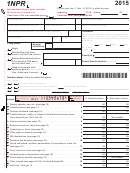

Form N-15 (Rev. 2011)

Page 2 of 4

Your Social Security Number

Your Spouse’s SSN

JCF112

Name(s) as shown on return

ID NO 01

Col. A - Total Income

Col. B - Hawaii Income

7

Wages, salaries, tips, etc. (attach Form(s) W-2) ..........

7

8

Interest income from the worksheet on page 39 of

the Instructions ............................................................

8

9

Ordinary dividends ......................................................

9

10

State income tax refund from the worksheet on

page 39 of the Instructions ..........................................

10

11

Alimony received .........................................................

11

If negative number, place a minus sign (-)

If negative number, place a minus sign (-)

-

-

12

Business or farm income or (loss) ...............................

12

13

-

-

Capital gain or (loss) from the worksheet on

page 39 of the Instructions .........................................

13

14

-

-

Supplemental gains or (losses)

(attach Schedule D-1) ................................................

14

15

IRA distributions ..........................................................

15

16

Pensions and annuities (see Instructions and

attach Schedule J, Form N-11/N-15/N-40) ..................

16

-

-

17

Rents, royalties, partnerships, estates, trusts, etc. ......

17

18

Unemployment compensation (insurance) ..................

18

19

-

-

Other income (state nature and source)

________________________________ ....................

19

-

-

†

20

Add lines 7 through 19 ..................... Total Income

20

21

Certain business expenses of reservists, performing

artists, and fee-basis government officials ..................

21

22

IRA deduction ..............................................................

22

23

Student loan interest deduction from the worksheet

on page 43 of the Instructions .....................................

23

24

Health savings account deduction ...............................

24

25

Moving expenses (attach Form N-139) .......................

25

26

Deductible part of self-employment tax .......................

26

27

Self-employed health insurance deduction ..................

27

28

Self-employed SEP, SIMPLE, and qualified plans .......

28

29

Penalty on early withdrawal of savings ........................

29

30

Alimony paid

(Enter name and SS No. of recipient)

________________________________ ....................

30

31

Payments to an individual housing account ..

31

32

First $5,881 of military reserve or Hawaii

national guard duty pay ................................

32

FORM N-15

1

1 2

2 3

3 4

4