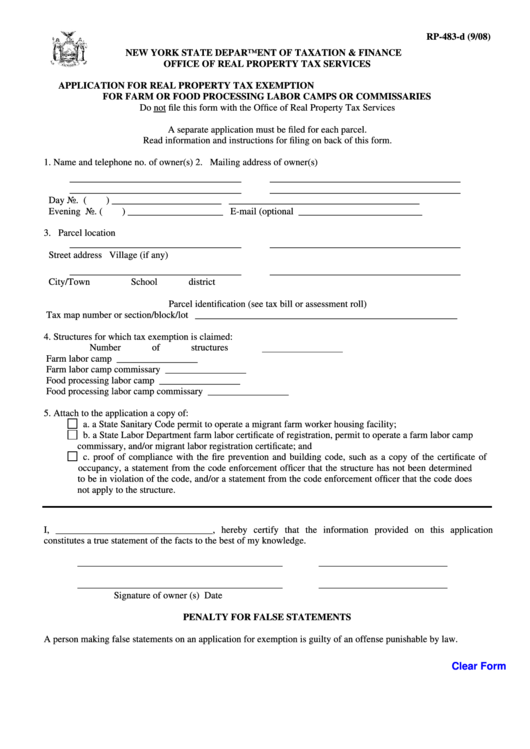

RP-483-d (9/08)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

APPLICATION FOR REAL PROPERTY TAX EXEMPTION

FOR FARM OR FOOD PROCESSING LABOR CAMPS OR COMMISSARIES

Do not file this form with the Office of Real Property Tax Services

A separate application must be filed for each parcel.

Read information and instructions for filing on back of this form.

1.

Name and telephone no. of owner(s)

2. Mailing address of owner(s)

____________________________________

________________________________________

____________________________________

________________________________________

Day No. (

) _______________________

________________________________________

Evening No. (

) ____________________

E-mail (optional __________________________

3.

Parcel location

____________________________________

________________________________________

Street address

Village (if any)

____________________________________

________________________________________

City/Town

School district

Parcel identification (see tax bill or assessment roll)

Tax map number or section/block/lot _______________________________________________________

4.

Structures for which tax exemption is claimed:

Number of structures

Farm labor camp

_________________

Farm labor camp commissary

_________________

Food processing labor camp

_________________

Food processing labor camp commissary

_________________

5.

Attach to the application a copy of:

a. a State Sanitary Code permit to operate a migrant farm worker housing facility;

b. a State Labor Department farm labor certificate of registration, permit to operate a farm labor camp

commissary, and/or migrant labor registration certificate; and

c. proof of compliance with the fire prevention and building code, such as a copy of the certificate of

occupancy, a statement from the code enforcement officer that the structure has not been determined

to be in violation of the code, and/or a statement from the code enforcement officer that the code does

not apply to the structure.

I, _________________________________, hereby certify that the information provided on this application

constitutes a true statement of the facts to the best of my knowledge.

___________________________________________

___________________________

___________________________________________

___________________________

Signature of owner (s)

Date

PENALTY FOR FALSE STATEMENTS

A person making false statements on an application for exemption is guilty of an offense punishable by law.

Clear Form

1

1 2

2