Instructions For Form M-2 - Certificate Of Retail Sales Of Liquid Fuel

ADVERTISEMENT

INSTRUCTIONS

STATE OF HAWAII—DEPARTMENT OF TAXATION

FORM M-2

INSTRUCTIONS FOR FORM M-2

(REV. 2013)

CERTIFICATE OF RETAIL SALES OF LIQUID FUEL

deduction, and reports the deduction in

Definition of Certain Terms

Changes You Should

Part IV of Form M-20A.

Used in Chapters 243 and

Note

248, HRS

When and Where to File

Effective July 1, 2013, the County of

“Alternative fuel” means methanol,

Kauai approved Resolution No. 2013-

The distributor must attach Form M-2

denatured ethanol, and other alcohols;

47, Draft 3, which increases the County

received from each retail dealer to its

mixtures containing 85 percent or more

of Kauai liquid fuel tax by an additional

monthly fuel tax return (Form M-20A),

by volume of methanol, denatured eth-

2 cents per gallon. The Resolution also

and file it with the Hawaii Department

anol, and other alcohols with gasoline

increases the County of Kauai liquid

of Taxation (Department). If the evapo-

or other fuels; natural gas; liquefied

fuel tax by an additional 2 cents per

ration allowance deduction claimed on

petroleum gas; hydrogen; coal-derived

gallon effective July 1, 2014.

the distributor’s Form M-20A is not ac-

liquid fuels; biodiesel; mixtures con-

companied by the applicable Form M-

taining 20 percent or more by volume

General Instructions

2(s), then the deduction will be disal-

of biodiesel with diesel or other fuels;

lowed.

Form M-2 is completed by the retail

fuels (other than alcohol) derived from

dealer and given to the distributor to

biological materials; and any other fuel

Where to Get Forms, Instruc-

report the number of gallons of vari-

that is substantially not a petroleum

tions, and Publications

ous types of liquid fuel sold by the re-

product and that the governor deter-

tail dealer during the month so that the

mines would yield a substantial energy

Forms, publications, and other docu-

distributor may compute its evaporation

security benefits or substantial environ-

ments, such as copies of Tax Infor-

allowance deduction. A distributor is

mental benefits.

mation Releases and Administrative

entitled to an evaporation allowance

Rules issued by the Department, are

“Power-generating facility” means

deduction of one gallon for each 99

available on the Department’s website

any electricity-generating facility that

gallons of fuel sold by a retail dealer in

at tax.hawaii.gov or you may contact

requires a permit issued under the

computing the distributor’s tax liability

a customer service representative at:

Federal Clean Air Act (42 U.S.C. 7401-

for the month under Hawaii Revised

7671q), the Hawaii air pollution control

Statutes (HRS) §243-10.

Pursuant

Voice: 808-587-4242

law (chapter 342B, HRS), or both.

to HRS §243-3, the retail dealer must

1-800-222-3229 (Toll-Free)

possess a valid permit in order for the

“Small Boats” means all vessels and

Telephone for the Hearing Impaired:

distributor to qualify for the evaporation

other water craft except those oper-

808-587-1418

allowance.

ated in overseas transportation beyond

1-800-887-8974 (Toll-Free)

the State, and ocean-going tugs and

Who Should File

Fax:

808-587-1488

dredges.

The retail dealer completes page 1 and

E-mail: Taxpayer.Services@hawaii.gov

submits it to the distributor.

Mail:

Taxpayer Services Branch

The distributor completes page 2 to

P.O. Box 259

compute the evaporation allowance

Honolulu, HI 96809-0259

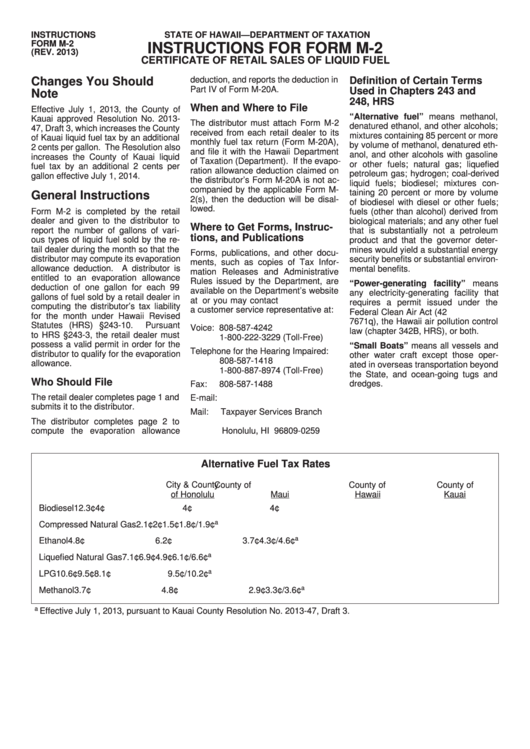

Alternative Fuel Tax Rates

City & County

County of

County of

County of

of Honolulu

Maui

Hawaii

Kauai

Biodiesel

12.3¢

4¢

4¢

4¢

a

Compressed Natural Gas

2.1¢

2¢

1.5¢

1.8¢/1.9¢

a

Ethanol

4.8¢

6.2¢

3.7¢

4.3¢/4.6¢

a

Liquefied Natural Gas

7.1¢

6.9¢

4.9¢

6.1¢/6.6¢

a

LPG

10.6¢

9.5¢

8.1¢

9.5¢/10.2¢

a

Methanol

3.7¢

4.8¢

2.9¢

3.3¢/3.6¢

a

Effective July 1, 2013, pursuant to Kauai County Resolution No. 2013-47, Draft 3.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2