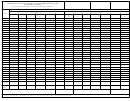

Import Schedule of Petroleum Products

General Instructions

Under Conn. Gen. Stat. §12-476a, the Commissioner of the

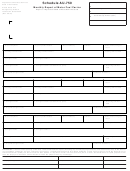

9. Consignor Name: Insert name of company or person shipping

Department of Revenue Services (DRS) directs all companies or

product from Connecticut.

persons transporting fuel into Connecticut or out of Connecticut to

complete Schedule AU-750, Monthly Report of Motor Fuel Carrier.

10. Consignor Address: Insert address of company or person

File this schedule with the DRS, Audit Division, Excise Taxes Unit,

shipping product from Connecticut.

on or before the last day of the month following the month being

reported.

11. Consignee Name: Insert name of company or person receiving

the product and the destination state.

Report for month ended: Insert month and year covering activity

being reported.

12. Consignee Address: Insert address of actual delivery point of

product.

CT Tax Registration Number: Enter the taxpayer’s Connecticut Tax

Regisration number.

13. Receiving terminal TCN: Insert the Terminal Control Number

issued by IRS.

Federal Employer Identification Number (FEIN) or Social Security

Number (SSN): Enter the taxpayer’s FEIN or, if the taxpayer is not

14. Original consignee name: Name of the original consignee if

a company, the taxpayer’s SSN.

different from the person or company to whom the fuel was delivered.

Signature, Title, and Telephone: This schedule must be signed by

15. Manner of delivery: Indicate the method a company or person

its preparer. The preparer must also list his or her title and a phone

used to deliver the product.

number where he or she can be reached. A paid preparer must sign

and date Form AU-750. Paid preparers must also enter their SSN

Mail the completed Schedule to:

or Preparer Tax Identification Number (PTIN) and their firm’s FEIN

Department of Revenue Services

in the spaces provided.

State of Connecticut

Excise Taxes Unit

Due Date: AU-750 is due on or before the last day of the month

25 Sigourney St Ste 2

following the month being reported.

Hartford CT 06106-5032

Make additional copies of this schedule if more than one page is

Additional Information

required.

Line Instructions

If you need additional information or assistance, please call the Excise

Taxes Unit at 860-541-3224, Monday through Friday, 8:30 a.m. to 4:30

1. Date of Shipment: Insert date that product was loaded on boat,

p.m.

barge, or vessel.

Visit the DRS website at to download and print

2. Type of Product Loaded: Insert type of product. Example:

Connecticut tax forms.

gasoline, alcohol, #2 fuel oil, kerosene, aviation fuels, diesel, #6 oil,

and any other type of fuel including compounds such as naptha, etc.

It is not necessary to indicate the grade of gasoline.

3. Date of Delivery: Insert date that product was pumped from boat,

barge, or vessel into storage in the destination state.

4. Gallons: Insert the total number of gallons pumped into storage in

the destination state. Gross gallons are preferred, but if not readily

available use net gallons and so indicate.

5. Boat, Barge, or Vessel Name: Insert name of boat, barge, or

vessel transporting product.

6. Loading Terminal Name: Insert name of terminal where product

was loaded onto boat, barge, or vessel.

7. Loading Terminal Address: Insert address of terminal where

product was loaded onto boat, barge, or vessel.

8. Loading Terminal TCN: Insert Terminal Control Number issued

by the Internal Revenue Service (IRS).

Schedule AU-750 Back (Rev. 09/10)

1

1 2

2