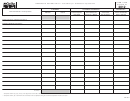

FORM 775P, SCHEDULE I – TURBINE-POWERED AIRCRAFT

• For general information, read the instructions on the Claim for Nebraska Personal Property Exemption,

Form

775P.

SPECIFIC INSTRUCTIONS

DATE ACQUIRED. The date acquired is the date the owner acquired the aircraft. For leased aircraft, the date acquired is

the date the lessor (owner) acquired the aircraft.

MAKE/DESCRIPTION. Enter the make and description of the aircraft. The registration number of the aircraft may also be

included. Include lease date if the aircraft is leased. To determine eligibility for exemption, this is the date the lessee took

possession of the aircraft and must be included.

ACTUAL LOCATION OF AIRCRAFT. Enter the address of the actual location where the aircraft is principally stored and

kept. For aircraft, only the airport name where the aircraft is principally stored and kept is needed.

NEBRASKA ADJUSTED BASIS. The Nebraska adjusted basis is the total purchase price (cost of placing the aircraft in

service) including, but not limited to costs for: delivery; installation; taxes; and fees. Enter the amount in whole dollars only.

RECOVERY PERIOD. The recovery period is the period over which the value of the property will be depreciated for

Nebraska property tax purposes.

Table

2, from the Nebraska Personal Property Return, includes a recovery period for

airplanes. Neb. Rev. Stat. § 77-120.

NET BOOK DEPRECIATION FACTOR. The net book depreciation factor is the percentage found in

Table 1

of the

Nebraska Personal Property Return, for the appropriate depreciation factor for the recovery period and the year acquired.

These depreciation factors are also listed in

Neb. Rev. Stat. §

77-120.

NET BOOK VALUE. The net book value is the Nebraska adjusted basis cost of the aircraft multiplied by the appropriate

depreciation factor for the recovery period and the year acquired.

LINE 15. Enter the total of the net book value for all aircraft listed on the page on line 15. If more than one page is used,

total each page separately. Then, enter the total of all Schedule I pages on Form 775P, under the Summary of Schedule I –

Turbine-Powered Aircraft.

NOTE: Sign and date the statement that the aircraft listed were not used for fundraising for, or transportation of, an elected

official.

Neb. Rev. Stat. §

77-4105(2)(a). The exemption for the tax year may be denied if it is determined the aircraft was

used for these purposes in the prior year.

Attach this schedule to the Form 775P.

1

1 2

2