6

Form 1118 (Rev. 12-2012)

Page

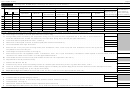

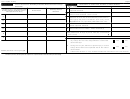

Schedule F

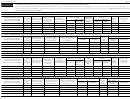

Schedule G

Reductions of Taxes Paid, Accrued, or Deemed Paid

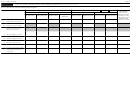

Gross Income and Definitely Allocable Deductions for Foreign

Part I - Reduction Amounts

Branches

Reduction of Taxes Under Section 901(e)—Attach

A

1. Foreign Country or U.S. Possession (Enter

3. Definitely Allocable

separate schedule

2. Gross Income

two-letter code from Schedule A, column 1.

Deductions

Use a separate line for each.)

Reduction of Foreign Oil and Gas Taxes—Enter

B

amount from Schedule I, Part II, line 6

A

Reduction of Taxes Due to International Boycott Provisions—

C

Enter appropriate portion of Schedule C (Form 5713), line 2b.

B

Important: Enter only “specifically attributable taxes” here.

Reduction of Taxes for Section 6038(c) Penalty—

D

C

Attach separate schedule

E

Other Reductions of Taxes—Attach schedule(s)

D

Total (add lines A through E). Enter here and on Schedule

E

B, Part II, line 3

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

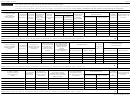

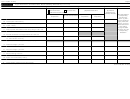

Part II - Other Information

F

1

During the tax year, did the corporation pay or accrue

Yes

No

any foreign tax that was disqualified for credit under

section 901(m)?

2

During the tax year, did the corporation pay or accrue

Yes

No

foreign taxes that were suspended due to the rules of

section 909?

Totals (add lines A through F)*

▶

If the answer to line 2 is "Yes," include the reduction amounts on Part I, line E above.

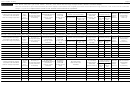

1118

* Note: The Schedule F totals are not carried over to any other Form 1118 Schedule. (These totals were already included in

Form

(Rev. 12-2012)

Schedule A.) However, the IRS requires the corporation to complete Schedule F under the authority of section 905(b).

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8