Form 600s-Ca - Consent Agreement Of Nonresident Shareholders Of S Corporations

ADVERTISEMENT

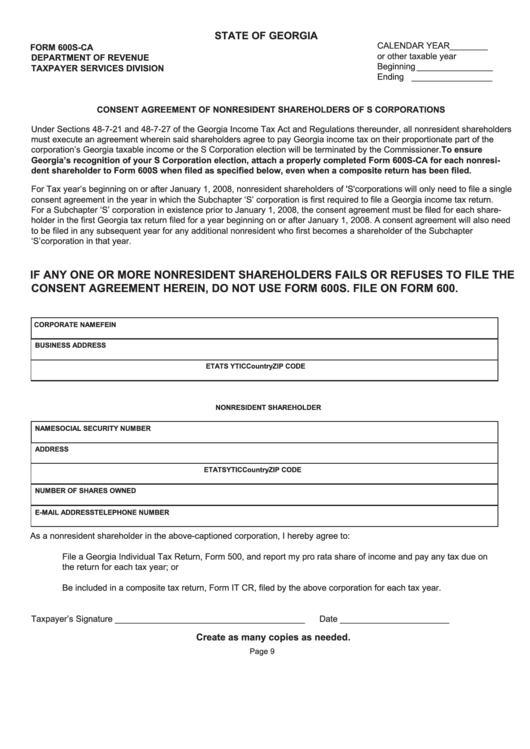

STATE OF GEORGIA

CALENDAR YEAR ________

FORM 600S-CA

or other taxable year

DEPARTMENT OF REVENUE

Beginning ________________

TAXPAYER SERVICES DIVISION

Ending _________________

CONSENT AGREEMENT OF NONRESIDENT SHAREHOLDERS OF S CORPORATIONS

Under Sections 48-7-21 and 48-7-27 of the Georgia Income Tax Act and Regulations thereunder, all nonresident shareholders

must execute an agreement wherein said shareholders agree to pay Georgia income tax on their proportionate part of the

corporation’s Georgia taxable income or the S Corporation election will be terminated by the Commissioner.To ensure

Georgia’s recognition of your S Corporation election, attach a properly completed Form 600S-CA for each nonresi-

dent shareholder to Form 600S when filed as specified below, even when a composite return has been filed.

For Tax year’s beginning on or after January 1, 2008, nonresident shareholders of 'S'corporations will only need to file a single

consent agreement in the year in which the Subchapter ‘S’ corporation is first required to file a Georgia income tax return.

For a Subchapter ‘S’ corporation in existence prior to January 1, 2008, the consent agreement must be filed for each share-

holder in the first Georgia tax return filed for a year beginning on or after January 1, 2008. A consent agreement will also need

to be filed in any subsequent year for any additional nonresident who first becomes a shareholder of the Subchapter

‘S’corporation in that year.

IF ANY ONE OR MORE NONRESIDENT SHAREHOLDERS FAILS OR REFUSES TO FILE THE

CONSENT AGREEMENT HEREIN, DO NOT USE FORM 600S. FILE ON FORM 600.

CORPORATE NAME

FEIN

BUSINESS ADDRESS

C

T I

Y

S

T

A

T

E

Country

ZIP CODE

NONRESIDENT SHAREHOLDER

NAME

SOCIAL SECURITY NUMBER

ADDRESS

C

T I

Y

S

T

A

T

E

Country

ZIP CODE

NUMBER OF SHARES OWNED

E-MAIL ADDRESS

TELEPHONE NUMBER

As a nonresident shareholder in the above-captioned corporation, I hereby agree to:

File a Georgia Individual Tax Return, Form 500, and report my pro rata share of income and pay any tax due on

the return for each tax year; or

Be included in a composite tax return, Form IT CR, filed by the above corporation for each tax year.

Taxpayer’s Signature ________________________________________

Date _______________________

Create as many copies as needed.

Page 9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1