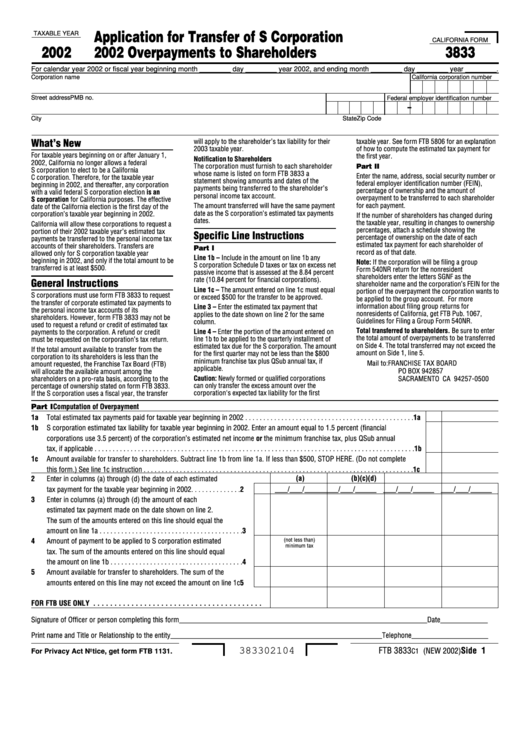

Form 3833 - Application For Transfer Of S Corporation - Overpayments To Shareholders - 2002

ADVERTISEMENT

Application for Transfer of S Corporation

TAXABLE YEAR

CALIFORNIA FORM

2002

3833

2002 Overpayments to Shareholders

For calendar year 2002 or fiscal year beginning month ________ day ________ year 2002, and ending month ________ day ________ year ________.

Corporation name

California corporation number

Street address

PMB no.

Federal employer identification number

-

City

State

Zip Code

will apply to the shareholder’s tax liability for their

taxable year. See form FTB 5806 for an explanation

What’s New

2003 taxable year.

of how to compute the estimated tax payment for

For taxable years beginning on or after January 1,

the first year.

Notification to Shareholders

2002, California no longer allows a federal

The corporation must furnish to each shareholder

Part II

S corporation to elect to be a California

whose name is listed on form FTB 3833 a

Enter the name, address, social security number or

C corporation. Therefore, for the taxable year

statement showing amounts and dates of the

federal employer identification number (FEIN),

beginning in 2002, and thereafter, any corporation

payments being transferred to the shareholder’s

percentage of ownership and the amount of

with a valid federal S corporation election is an

personal income tax account.

overpayment to be transferred to each shareholder

S corporation for California purposes. The effective

for each payment.

The amount transferred will have the same payment

date of the California election is the first day of the

date as the S corporation’s estimated tax payments

corporation’s taxable year beginning in 2002.

If the number of shareholders has changed during

dates.

the taxable year, resulting in changes to ownership

California will allow these corporations to request a

percentages, attach a schedule showing the

portion of their 2002 taxable year’s estimated tax

Specific Line Instructions

percentage of ownership on the date of each

payments be transferred to the personal income tax

estimated tax payment for each shareholder of

accounts of their shareholders. Transfers are

Part I

record as of that date.

allowed only for S corporation taxable year

Line 1b – Include in the amount on line 1b any

beginning in 2002, and only if the total amount to be

Note: If the corporation will be filing a group

S corporation Schedule D taxes or tax on excess net

transferred is at least $500.

Form 540NR return for the nonresident

passive income that is assessed at the 8.84 percent

shareholders enter the letters SGNF as the

rate (10.84 percent for financial corporations).

General Instructions

shareholder name and the corporation’s FEIN for the

Line 1c – The amount entered on line 1c must equal

portion of the overpayment the corporation wants to

S corporations must use form FTB 3833 to request

or exceed $500 for the transfer to be approved.

be applied to the group account. For more

the transfer of corporate estimated tax payments to

information about filing group returns for

Line 3 – Enter the estimated tax payment that

the personal income tax accounts of its

nonresidents of California, get FTB Pub. 1067,

applies to the date shown on line 2 for the same

shareholders. However, form FTB 3833 may not be

Guidelines for Filing a Group Form 540NR.

column.

used to request a refund or credit of estimated tax

Total transferred to shareholders. Be sure to enter

payments to the corporation. A refund or credit

Line 4 – Enter the portion of the amount entered on

the total amount of overpayments to be transferred

line 1b to be applied to the quarterly installment of

must be requested on the corporation’s tax return.

on Side 4. The total transferred may not exceed the

estimated tax due for the S corporation. The amount

If the total amount available to transfer from the

amount on Side 1, line 5.

for the first quarter may not be less than the $800

corporation to its shareholders is less than the

minimum franchise tax plus QSub annual tax, if

Mail to:

FRANCHISE TAX BOARD

amount requested, the Franchise Tax Board (FTB)

applicable.

PO BOX 942857

will allocate the available amount among the

shareholders on a pro-rata basis, according to the

Caution: Newly formed or qualified corporations

SACRAMENTO CA 94257-0500

can only transfer the excess amount over the

percentage of ownership stated on form FTB 3833.

corporation's expected tax liability for the first

If the S corporation uses a fiscal year, the transfer

Part I

Computation of Overpayment

1a

Total estimated tax payments paid for taxable year beginning in 2002 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1a

1b

S corporation estimated tax liability for taxable year beginning in 2002. Enter an amount equal to 1.5 percent (financial

corporations use 3.5 percent) of the corporation’s estimated net income or the minimum franchise tax, plus QSub annual

tax, if applicable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1b

1c

Amount available for transfer to shareholders. Subtract line 1b from line 1a. If less than $500, STOP HERE. (Do not complete

this form.) See line 1c instruction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1c

(a)

(b)

(c)

(d)

2

Enter in columns (a) through (d) the date of each estimated

___/___/_____ ___/___/_____ ___/___/_____ ___/___/_____

tax payment for the taxable year beginning in 2002. . . . . . . . . . . . . .

2

3

Enter in columns (a) through (d) the amount of each

estimated tax payment made on the date shown on line 2.

The sum of the amounts entered on this line should equal the

amount on line 1a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

(not less than)

4

Amount of payment to be applied to S corporation estimated

minimum tax

tax. The sum of the amounts entered on this line should equal

the amount on line 1b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5

Amount available for transfer to shareholders. The sum of the

amounts entered on this line may not exceed the amount on line 1c

5

FOR FTB USE ONLY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Signature of Officer or person completing this form____________________________________________________________________Date _____________

Print name and Title or Relationship to the entity__________________________________________________________Telephone _____________________

383302104

FTB 3833

Side 1

(NEW 2002)

For Privacy Act Notice, get form FTB 1131.

C1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4