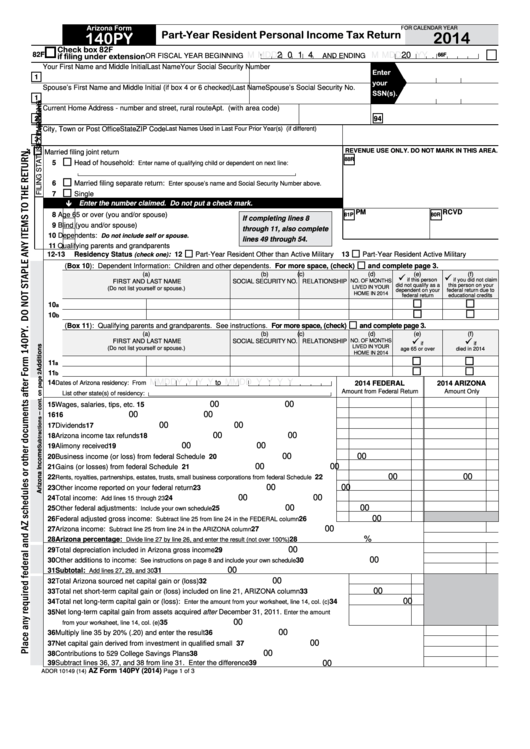

Arizona Form 140py - Part-Year Resident Personal Income Tax Return - 2014

ADVERTISEMENT

Arizona Form

FOR CALENDAR YEAR

Part-Year Resident Personal Income Tax Return

2014

140PY

Check box 82F

M M D D

2 0 1 4

M M D D

2 0

Y Y

82F

if filing under extension

OR FISCAL YEAR BEGINNING

AND ENDING

.

66F

Your First Name and Middle Initial

Last Name

Your Social Security Number

Enter

1

your

Spouse’s First Name and Middle Initial (if box 4 or 6 checked)

Last Name

Spouse’s Social Security No.

SSN(s).

1

Current Home Address - number and street, rural route

Apt. No.

Daytime Phone (with area code)

2

94

City, Town or Post Office

State

ZIP Code

Last Names Used in Last Four Prior Year(s) (if different)

3

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

4

Married filing joint return

88R

5

Head of household:

Enter name of qualifying child or dependent on next line:

6

Married filing separate return:

Enter spouse’s name and Social Security Number above.

7

Single

Enter the number claimed. Do not put a check mark.

PM

RCVD

8

Age 65 or over (you and/or spouse)

81P

80R

If completing lines 8

9

Blind (you and/or spouse)

through 11, also complete

10

Dependents:

Do not include self or spouse.

lines 49 through 54.

11

Qualifying parents and grandparents

12-13

Residency Status

: 12

Part-Year Resident Other than Active Military

13

Part-Year Resident Active Military

(check one)

(Box 10): Dependent Information: Children and other dependents. For more space, (check)

and complete page 3.

(a)

(b)

(c)

(d)

(e)

(f)

if this person

if you did not claim

NO. OF MONTHS

FIRST AND LAST NAME

SOCIAL SECURITY NO.

RELATIONSHIP

did not qualify as a

this person on your

LIVED IN YOUR

(Do not list yourself or spouse.)

dependent on your

federal return due to

HOME IN 2014

federal return

educational credits

10

a

10

b

(Box 11): Qualifying parents and grandparents. See instructions. For more space, (check)

and complete page 3.

(a)

(b)

(c)

(d)

(e)

(f)

FIRST AND LAST NAME

SOCIAL SECURITY NO.

RELATIONSHIP

NO. OF MONTHS

if

if

LIVED IN YOUR

(Do not list yourself or spouse.)

age 65 or over

died in 2014

HOME IN 2014

11

a

11

b

M M D D Y Y Y Y

M M D D Y Y Y Y

14

to

Dates of Arizona residency: From

2014 FEDERAL

2014 ARIZONA

Amount from Federal Return

Amount Only

List other state(s) of residency:

00

00

15 Wages, salaries, tips, etc. ................................................................................................... 15

00

00

16 Interest................................................................................................................................. 16

00

00

17 Dividends ............................................................................................................................. 17

00

00

18 Arizona income tax refunds ................................................................................................. 18

00

00

19 Alimony received ................................................................................................................. 19

00

00

20 Business income (or loss) from federal Schedule C............................................................ 20

00

00

21 Gains (or losses) from federal Schedule D.......................................................................... 21

00

00

22

22

Rents, royalties, partnerships, estates, trusts, small business corporations from federal Schedule E....

00

00

23 Other income reported on your federal return ..................................................................... 23

00

00

24 Total income:

.................................................................................... 24

Add lines 15 through 23

00

00

25 Other federal adjustments:

........................................................... 25

Include your own schedule

00

26 Federal adjusted gross income:

.............. 26

Subtract line 25 from line 24 in the FEDERAL column

00

27 Arizona income:

.............................................................................. 27

Subtract line 25 from line 24 in the ARIZONA column

%

28 Arizona percentage:

.......................................................... 28

Divide line 27 by line 26, and enter the result (not over 100%)

00

29 Total depreciation included in Arizona gross income .................................................................................................. 29

00

30 Other additions to income:

...................................................... 30

See instructions on page 8 and include your own schedule

00

31 Subtotal:

................................................................................................................................ 31

Add lines 27, 29, and 30

00

32 Total Arizona sourced net capital gain or (loss) ................................................................... 32

00

33 Total net short-term capital gain or (loss) included on line 21, ARIZONA column ............... 33

00

34 Total net long-term capital gain or (loss):

34

Enter the amount from your worksheet, line 14, col. (c)

35 Net long-term capital gain from assets acquired after December 31, 2011.

Enter the amount

00

.......................................................................................... 35

from your worksheet, line 14, col. (e)

00

36 Multiply line 35 by 20% (.20) and enter the result ...................................................................................................... 36

00

37 Net capital gain derived from investment in qualified small business......................................................................... 37

00

38 Contributions to 529 College Savings Plans .............................................................................................................. 38

00

39 Subtract lines 36, 37, and 38 from line 31. Enter the difference ................................................................................ 39

AZ Form 140PY (2014)

Page 1 of 3

ADOR 10149 (14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3