l

*110401120000*

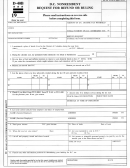

D-40B PAGE 2

Enter your last name.

Enter your social security number.

Other information

9

Place of birth, City

State

Date of birth (MM/DD/YY)

M M D D Y Y

10 State where you last voted

Date you voted

Yes

No

Are you registered to vote in DC?

11

Complete only if you were in military service during 2011.

State where enlisted

Enlistment date

State of domicile declared on DD Form 2058

Residence at time of enlistment

(MM/DD/YY)

State

or Country or U.S. commonwealth/U.S. territory

Employment history

12

Current employer

From (MM/DD/YY)

Current employer’s address (number and street)

City

State

Zip Code

Previous employer

From (MM/DD/YY)

To (MM/DD/YY)

Previous employer’s address (number and street)

City

State

Zip Code

Property information

13

List the type and location of any DC real property you own.

Type of property

Address (number, street and zip code)

Type of property

Address (number, street and zip code)

14

List amount of income tax and/or intangible personal property tax you paid in 2011 to the jurisdiction of your 2011 permanent residence listed on Line 7.

Amount

.00

$

Income tax

Fill in tax type:

.00

$

Intangible personal property tax

Signature

Under penalties of law, I declare that I have examined this request and any attached statements, and, to the best of my knowledge, it is correct.

Preparer’s signature

Your signature

Date

Send the completed D-40B to:

Office of Tax and Revenue, PO Box 209, Washington DC 20044-0209

Preparer’s PTIN

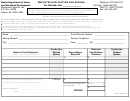

How will we respond to your request?

Who must file a Form D-40B?

• We will send you a refund for the amount you request if we determine you were not a resident

Any nonresident of DC claiming a refund of DC income tax

of DC during 2011; or

withheld or paid by estimated tax payments must file a

• Based on the information you provide, we may determine that you qualify as a DC resident. If so,

D-40B. A nonresident is anyone whose permanent home

we will send you a notice of your residency status and require that you file either a DC Form D-40

was outside DC during all of 2011 and who did not live in

DC for a total of 183 days or more during 2011. A joint

or DC Form D-40EZ tax return.

request for refund is not permitted. Attach all statements

Notice: In order to comply with new banking rules, we will not issue a refund to or

showing DC withholding to the front of page 1.

through a foreign financial institution. Instead, we will issue a paper check.

l

l

2011 Form D-40B P2

Nonresident Request for Refund page 2

1

1 2

2