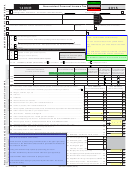

Arizona Form 140nr - Nonresident Personal Income Tax Return - 2011 Page 35

ADVERTISEMENT

Form 140NR

2011

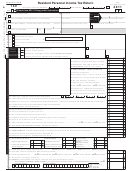

Arizona Tax Tables X and Y

For Form 140NR

Table X - Use Table X if your filing status is Single or Married Filing Separate

(a)

(b)

(c)

(d)

(e)

(f)

If taxable income

Enter the amount

Multiply

Enter the

Subtract

Your tax.

from Form 140NR,

from Form

the

result

Round the result

page 1, line 21

140NR, page 1,

amount

and enter this

is:

line 21

entered in

amount on

column (b)

Form 140NR,

Over

But

by

page 1, line 22

Not over

$0

$10,000

X

.0259

=

-

0.00

=

$10,000

$25,000

X

.0288

=

-

$

29.00

=

$25,000

$50,000

X

.0336

=

-

$ 149.00

=

$50,000

$150,000

X

.0424

=

-

$ 589.00

=

$150,000

and over

X

.0454

=

-

$ 1,039.00

=

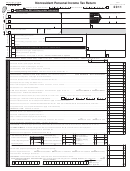

Table Y - Use Table Y if your filing status is Married Filing Joint or Head of Household

(a)

(b)

(c)

(d)

(e)

(f)

If taxable income

Enter the amount

Multiply

Enter the

Subtract

Your tax.

from Form 140NR,

from Form

the

result

Round the result

page 1, line 21

140NR, page 1,

amount

and enter this

is:

line 21

entered in

amount on

column (b)

Form 140NR,

Over

But

by

page 1, line 22

Not over

$0

$20,000

X

.0259

=

-

0.00

=

$20,000

$50,000

X

.0288

=

-

$

58.00

=

$50,000

$100,000

X

.0336

=

-

$ 298.00

=

$100,000

$300,000

X

.0424

=

-

$ 1,178.00

=

$300,000

and over

X

.0454

=

-

$ 2,078.00

=

21

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37